Whether you’re a veteran agent or a rookie hoping to sound authoritative during your first transaction, you need to be able to succinctly explain common real estate terms and definitions to your clients. Even if you know every one of the 136 real estate terms on this list and how to use them, your clients expect you to be their interpreter. This comprehensive list of real estate definitions will help you ensure you’re communicating with clients effectively. After all, great communication leads to closed deals.

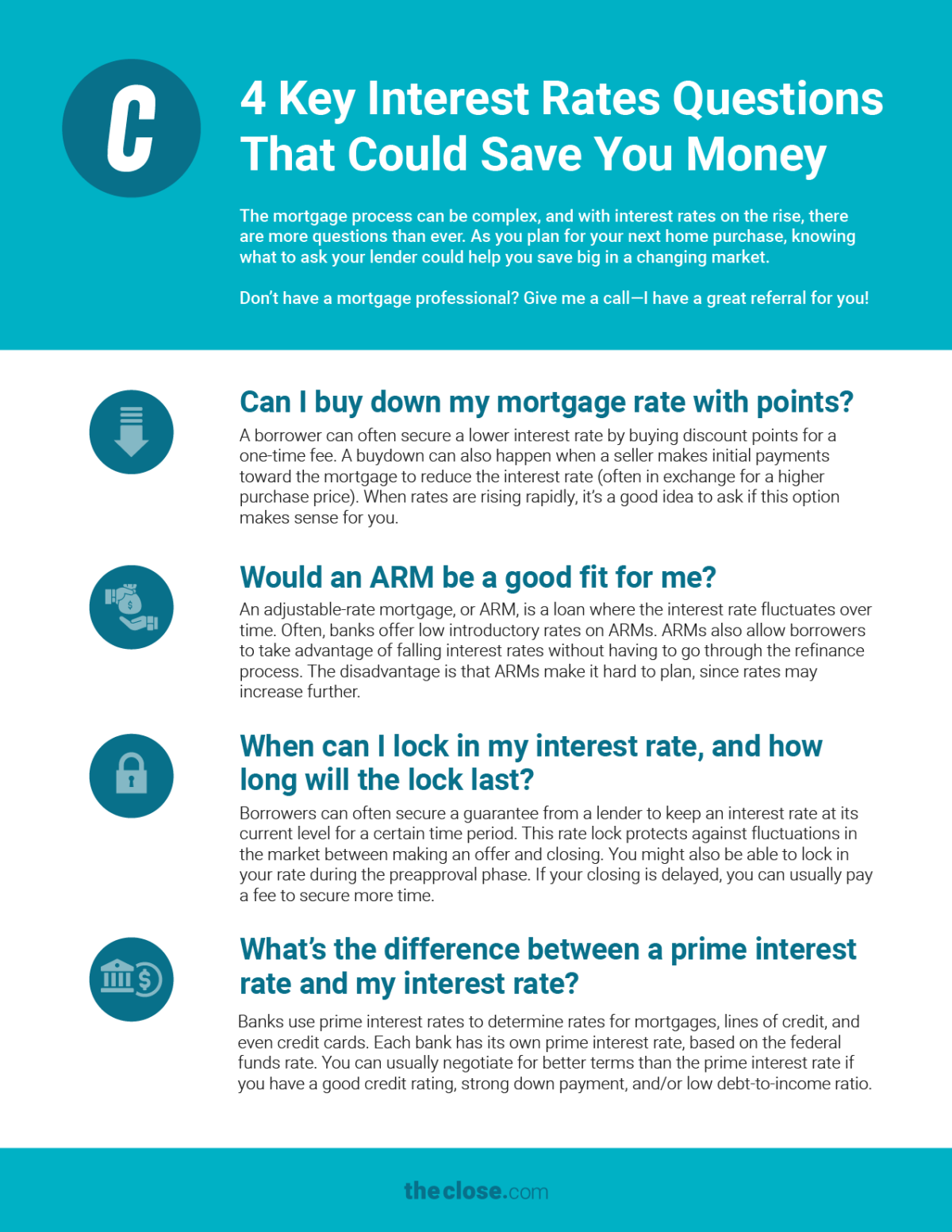

Furthermore, in today’s market, understanding our complex mortgage industry could actually help you close more deals and maybe even save clients money. So we’ve included a handy download with questions your clients should ask their mortgage broker. Download it now and add it to your new homebuyer drip campaign for 2024!

4 Key Interest Rate Questions That Could Save Your Clients Money

We present our glossary of 136 real estate terms you need to know—and be able to define for your clients.

A I B I C I D I E I F I G I H I I I J I K I L I M I N I O I P I Q I R I S I T I U I V I W I X I Y I Z

1031 Exchange

This tool, also known as a like-kind exchange, allows investors to defer paying capital gains taxes on a sale. The catch is that they must sell one property and buy a similar one within a set time frame. If you want to work with real estate investor clients, read our own Sean Moudry’s simple, yet thorough rundown: How to Explain 1031 Exchange Rules to Your Clients.

A

Acceleration clause

Make sure clients who see an acceleration clause in their mortgage contracts understand that this allows their lender to demand repayment of the loan in full if they default on the loan.

Active contingent

To help your clients understand contingencies, use the word “conditional.” If a property is active contingent, a buyer has submitted an offer to purchase a property, but the sale won’t be finalized until certain conditions, or contingencies, are met. A contingency might be the buyer selling their current house, requiring certain repairs to be made, or obtaining a clean termite inspection.

It might feel stressful, but handling contingencies well is actually a time when you, as the agent, can really shine. Sure, deals can fall apart. There are plenty of things out of your control, like a foundation crumbling, undisclosed liens, or all the seller’s DIY repairs. But if you shepherd your clients through the process with the greatest attention to detail, they won’t forget it.

The Ultimate House Hunting Checklist for Your Clients in 2024

Active with contract

Your client might wonder if they can still view a property that’s active with contract (also known as “active under contract”). Let them know that it’s totally fine, assuming the seller agrees, but make sure they understand that the property has an offer with contingencies that have not yet been met. There is always a chance a sale might not go through, especially in today’s wild interest rate market. But if and when the contingencies have been met, the property will be listed as “pending.”

Addendum

Clients will come across all sorts of addenda, or supplemental documents that modify a specific part of an existing contract, in the transaction. They must be agreed upon and signed by both parties. One of the most common addenda, and an easy example for clients to understand, is the lead paint disclosure for homes built before 1978, which alerts buyers to potential hazards.

Adjustable-rate mortgage (ARM)

Clients should always consult with their mortgage professional when it comes to specific questions about their mortgage. But it’s helpful to be able to explain the basics.

Clients might be interested in an ARM because it allows borrowers to take advantage of interest rate decreases without having to go through a whole refinance process and pay additional closing costs. Since an ARM’s interest rate fluctuates over time depending on various market factors, some experts believe they save borrowers money in the long run. The disadvantage, of course, is that ARMs make it hard to plan and budget since there is always the possibility (and current reality) of rates increasing.

What About ARMs? 4 Loan Questions Worth Asking

Adjustment date

Clients with ARMs need to know their adjustment date, because that’s when they may see a change to the interest rate in an adjustable-rate mortgage. The time between a change in rates is called an adjustment period, and the length of this period depends on the loan. For most ARMs, the adjustment date occurs annually.

Amortization

This is one of those words everyone has heard but few really understand. When it comes to property financing, amortization is the preset schedule of mortgage loan payments, including interest, over time. Generally the payments are scheduled monthly over a period of 15 or 30 years. You know you love a good amortization schedule. How else would you and your clients understand how much is being paid in principal and interest over the years?

Annual percentage rate (APR)

Clients may be confused about the difference between an interest rate on their mortgage loan and an APR. Simply put, the APR includes all of the fees involved, including points. It’s really just the total amount, expressed as a percentage, that it costs to borrow money, including interest and fees.

Apps

There are an infinite number of real estate apps out there to boost agent productivity. We have a roundup of our current favorites and bet there is at least one that will solve for one of your pain points.

The 15 Best Apps for Real Estate Agents (2024)

Appraisal

The appraisal—an estimate of how much a home is worth— can be a stressful point in the homebuying process for clients. If an appraiser assigns a lower value to the property than what the buyer has offered, the lender might not fund the entire loan amount. The appraiser, after all, is computing the fair market value of a property to ensure that the loan amount is reasonable.

There are options, though, and y’all are the best at navigating these tricky waters. The most common solution is to negotiate with the seller to bring down the price to the appraised value. You can challenge the appraisal if it’s really off the mark. Or, the buyer can put more money down and reduce the loan amount.

Appreciation

Appreciation of a home’s value can happen over time from a number of factors, like inflation or the neighborhood becoming the it spot. To calculate a property’s projected increase in value over time, divide the change in value by the initial cost of the property and multiply it by 100. Appreciation may not be your clients’ main motivator, but it should always be a consideration. After all, (shout it from the rooftops!) real estate is one of the safest and most profitable investments one can make.

As-is

Was that knob-and-tube wiring in the attic? Clients who’ve binge-watched HGTV might be excited about a fixer-upper, but you can help them understand what “as-is” really means. Basically, the property is being sold in its current condition without any improvements, repairs, guarantees, or warranties.

Assessed value

This is the dollar value the local government assigns to a home based on square footage, condition, and relative comps. It helps determine how much owners will pay in property taxes. It’s often presented as a percentage of the fair market value.

Assignment

This is when the seller signs over all rights and obligations related to a property to the buyer before the actual closing. This is a bit of legalese and probably not a term you’d use in casual conversation with clients.

Assumable mortgage

You don’t hear much about assumable mortgages anymore. If a client asks, it means the buyer will take over the seller’s existing mortgage and existing house-related debt. This might happen if a parent or spouse dies and the heirs take over the mortgage. An assumption clause will be included in the mortgage’s provisions and the lender will typically hold the buyer to the same eligibility requirements as the original borrower.

While this type of arrangement may be attractive in today’s rising rates environment, you’ll want to explain to your clients that it’s very difficult to take over a mortgage. This is thanks to the Garn-St. Germain Depository Institutions Act of 1982 (“Oh, of course,” they’ll say, and nod their heads knowingly). Basically, the law protects lenders from assumable mortgages with below-market interest rates. Most mortgages now have a “due-on-sale” clause, which requires the borrower to repay the loan in full if they sell the property.

B

Balloon mortgage

Clients who opt for a balloon mortgage will pay smaller monthly payments at first, followed by one larger-than-typical payment (the balloon) at the end of the loan. They generally come with lower interest rates and the ability to get a higher loan amount. Common in the 2000s, they aren’t as popular now. The final balloon payment can be massive, and one misstep could leave the borrower upside down.

Biweekly mortgage

Borrowers with a biweekly mortgage will submit their mortgage payments twice a month as opposed to once. This results in 26 payments annually, which means paying one extra month per year. A borrower with a 30-year biweekly mortgage could pay their loan off sooner than those with traditional payment schedules, even by year 25.

Bridge loan

Got clients who found their dream home before selling their current one? A bridge loan can be a real life-saver in this situation. Essentially, it’s a short-term loan that helps a buyer cover costs in the interim between buying a new house and selling one. It could also mean you have the chance to be the client’s buying and listing agent!

Broker

Clients may want to know the difference between an agent and a broker. After all, part of the commission they’re paying may go to a broker. You can explain that a broker is equivalent to a manager in the real estate world: an agent with a certain level of experience who has taken the state-mandated education and examinations to meet the requirements to become a licensed real estate broker. (Of course, some states refer to a real estate agent as a “broker.”)

Real Estate Broker vs. Agent: A Head-to-Head Analysis

Buydown

This is a really helpful concept for today’s market. You’ll want to encourage your clients to consult with their mortgage specialist, but often borrowers can secure a lower interest rate by buying discount points as a one-time fee paid at closing. A buydown can also exist when a seller makes initial payments toward the mortgage to reduce the interest rate, usually in exchange for a higher purchase price. Both routes represent great options to consider if interest rates are, ahem, rapidly rising.

C

Call option

This gives a buyer an exclusive right, or option, to purchase a certain property at a set time for a specified price.

Cash-out refinance

A homeowner can refinance their property for more than its value and take the added amount as cash. It generally results in a higher interest rate or additional points, but it’s a way for homeowners to leverage their equity in a property.

Certificate of eligibility

When working with veterans, you’ll want to prepare them for a fair amount of paperwork. The certificate of eligibility is but one example of this. It’s an official form certifying that a veteran has met the terms that qualify someone for a VA loan. VA loans might have a lot of red tape, but they can be excellent, affordable options for service members and their spouses.

Certificate of reasonable value

This is a form from the Department of Veterans Affairs outlining the maximum amount that can be issued to a borrower of a VA loan. Like we said, lots of paperwork.

How to Become a Successful Military Relocation Professional (MRP)

Chain of title

As clients get ready for closing, they’ll hear a lot about the title. Chain of title is an historical record of previous owners of a property that’s essential in establishing the legal ownership of the property. An established chain of title helps protect the buyer from future challenges to ownership. A title search helps create that chain and is usually conducted by a lawyer or title company prior to closing.

Clear title

Clients may want to know why you’re doing a happy dance when you hear the property has a clear title. A clear title, you explain, indicates that there are no liens or encumbrances on the property. It’s also known as a “just title” or “free-and-clear title.” A title with liens or encumbrances has a “cloudy title.” Properties can have their titles cleared, but it can take a long time and may even require legal action.

Closing

Pay day! Another happy dance. Also known as the agreed-upon date when a property changes ownership from the seller to the buyer.

Closing costs

You can explain early in the process that closing costs are all of the additional fees related to the purchasing or selling of a property. They are generally between 3% and 5% of the purchase price and account for appraisals, taxes, attorney fees, and title insurance.

It’s really important that your clients are keyed into this crucial part of the process. Clients will need an exact accounting of the total amount owed in closing costs. They’ll also need to ensure that those funds are properly wired or deposited on the closing date.

Remember that time when a wire transfer didn’t go through from a third party who was hiking on top of a mountain and couldn’t be reached? Prepare your clients to double, triple, quadruple check everything related to these costs and their transfer.

Co-borrower

Don’t you love it when the co-borrower is the client’s dad who comes along on the inspection and is suddenly an expert on chimney engineering? If your clients are concerned about getting approved for a loan, you can remind them that a co-borrower agrees to back the borrower in a mortgage loan. They sign all of the loan documents, have interest in the property being purchased, and are required to pay the monthly payments if the primary borrower is unable to.

Commission

My guess is that, while you know exactly what a commission is and how it works, your clients might have some questions.

You can explain to them that a commission is the amount charged by the real estate agents who lead the transaction. It is almost always paid by the seller. Generally 6% of the purchase price of the property, commissions are usually split between the buyer and seller agents and then between the agents and their brokers.

Community property

In a community property state—namely Arizona, California, Delaware, Idaho, Louisiana, Maryland, Nevada, New Hampshire, New Jersey, New Mexico, North Carolina, South Carolina, Tennessee, Texas, Washington, and Wisconsin—any real estate purchased during a marriage belongs equally to each spouse, 50-50.

How to Get Listings in Any Market (Without Spending a Fortune)

Comparable sales

Of course, the ultimate pricing decision lies with the seller, but we hope they listen to you because you’ll come up with a price based on the science and art of the comparative market analysis (CMA). To create a CMA (see below), you’ll collect similar properties that have closed recently, also known as comps.

Comparative market analysis (CMA)

When you sit down for your listing appointment, one of the most important things you’ll have with you is your comparative market analysis. This is an estimate of a property’s worth, determined by local comparable sales, market data, sale history, and location.

CMAs are a place where an agent can really show off their knowledge and professional value. In this article, our own Chris Linsell explains how to create an unbeatable CMA.

How to Do a Comparative Market Analysis: A Step-by-Step Guide

Compound interest

The concept of compound interest can perhaps best be described by Benjamin Franklin, who allegedly said, “money makes money. And the money that money makes, makes money.” Albert Einstein supposedly called compound interest mankind’s greatest invention.

It’s essentially the idea that if you invest your returns into more investment, that money multiplies. This works in your client’s favor if they are collecting on investments, but against them when applied to debt.

Construction loan

A construction loan is a short-term loan that covers the cost to build a property until the owner can secure long-term financing.

Contingency

Clients often have trouble understanding the difference between contingent and pending. A property is considered contingent when the buyer has made an offer to purchase it, as long as certain conditions are met. This could mean repairs need to be made or the buyer’s home needs to sell. Whatever these contingencies are, they have to be resolved before the property can close.

Conventional mortgage

Conventional mortgages are the ones that aren’t part of a specific government program, such as Fannie Mae, Freddie Mac, USDA, or the VA. Generally, borrowers who go the conventional route are lower risk, offer a larger down payment, and don’t require mortgage insurance.

Help Clients Navigate a Volatile Mortgage Environment

Convertible adjustable-rate mortgage

It’s kind of like a fixed-rate mortgage and an adjustable-rate mortgage had a baby. A convertible ARM is a mortgage with a much lower interest rate at the start of the loan, where the interest rate fluctuates during the life of the loan, usually every six months. But, unlike a traditional ARM, a borrower has the option to switch to a fixed-rate mortgage. These mortgages were developed in the 1980s in an era of double-digit interest rates when borrowers were hopeful that the rates wouldn’t rise much more.

Cost of funds index (COFI)

Used to calculate variable interest in adjustable-rate mortgages, COFI is a benchmark determined by average regional interest rates incurred by financial institutions.

Customer relationship manager (CRM)

A CRM helps agents track leads in their sales funnel. Robust CRMs have email and text drip campaigns and many even let you call prospects and track responses directly through the system. The best CRM is one you’ll use, so make sure it’s user-friendly, has all the bells and whistles you need, and helps you reach out to prospects and leads quickly and consistently.

The 11 Best Real Estate CRMs of 2024

D

Days on market (DOM)

As a seller’s agent, you’re counting the days a listing is on the market. Chances are your client is too. Which is why she’s calling you before breakfast.

Simply put, this measures the number of days a property is for sale, from the day it is listed on the multiple listing service (MLS) to the day a buyer and seller are under contract.

Deed

The deed is a legal document recording the transaction of title (or official ownership transfer) from the seller to the buyer. It is recorded at the local county clerk’s office. Really just a combo of legalese and paperwork, but everyone feels better having a tangible representation of ownership.

Deed in lieu of foreclosure

This is when a homeowner turns a deed over to the mortgaging bank to avoid going into foreclosure. This allows the borrower to avoid personal liability for the remaining unpaid debt. In some cases, they may be able to continue living in the property.

Default

To default on a mortgage loan means the borrower has stopped submitting monthly payments.

Delinquency

Borrowers can go into delinquency if they have stopped paying their monthly mortgage loan payments for a certain time period. At this point, the lender has the option to start foreclosure proceedings.

Debt-to-income ratio (DTI)

This is an important calculation for lenders when considering mortgage applications and whether borrowers can afford to make payments. You can help your clients calculate their DTI by adding together all of their monthly payments and dividing the total by their gross monthly income.

Discount points

Borrowers may pay these fees at closing to secure a lower interest rate.

Down payment

Crucial question for your clients: How much can you put down? After a good look at their finances, a nice long chat with their financial advisers, and an extensive application with a mortgage lender, they might finally have an answer.

A down payment is the amount of money that a buyer uses to secure a mortgage on a property. Conventional loans often require 20% of the purchase price, while government-backed mortgages could require much less (sometimes nothing!). Loans with less than 20% down often require buyers to pay private mortgage insurance until they reach a certain equity ratio.

Due diligence period

What if your clients are asking about their due diligence period? Easy, you explain: It’s a specified amount of time after an offer is made during which the buyer can inspect the property and review relevant documents. It’s a chance for the buyer to be sure in their decision to move forward with the purchase. It’s also a period when seller’s agents tend to bite their nails, breath rapidly into paper bags, and yes, they will have that third margarita, thank you.

Due-on-sale clause

Also called an acceleration clause, this requires the borrower to repay the loan in full when a property (or collateral) is sold. It all goes back to that riveting Garn-St. Germain Depository Institutions Act, which was put into place to protect lenders from assumable mortgages.

E

Earnest money deposit

First-time buyers may be new to this concept, so it is worth bringing it up in the beginning of the home-search process. Also known as a “good faith deposit,” it’s the amount of money a buyer puts in escrow to show their commitment to purchase a property. Usually a small percentage (1% to 3%) of the purchase price, it goes toward the purchase at closing. If the sale falls through, the seller could keep some or all of the earnest money, depending on the situation.

Easement

When examining a property—to buy or sell—it’s crucial to first understand if there are any easements on the property. An easement is the legal right for a non-owner to use or cross a property for a specific purpose while the title remains with the owner.

One example is someone using a private road to access their own land. Another one that is popular down here in Charleston is a conservation easement. This means that the owner has donated a portion of the property to be protected because it has historic, cultural, or environmental significance. The owner can receive tax credits in exchange.

Eminent domain

This is the government’s right to use private land for a specific, public purpose after compensating the owner.

Encroachment

An encroachment is a violation of an owner’s property rights by building or extending onto their land without permission. For example, if you build a fence and part of it is on your neighbor’s yard, that’s encroachment.

Encumbrance

You just never want to hear that a property has an encumbrance. Never. Want to. Hear it. And if you do hear it, you need to explain it to your client. An encumbrance is a claim against a property such as a mortgage, lien, or easement. These can affect the transferability of ownership.

Equal Credit Opportunity Act

This was groundbreaking legislation when it passed in 1974. Today it offers agents the opportunity to further the cause of equality and justice in our professional transactions. The act protects potential borrowers against creditors who would discriminate against their mortgage application based on race, color, religion, national origin, sex, marital status, age, or acceptance of public assistance.

7 Real Estate Scams & Ways Agents Can Protect Their Clients

Equity

This is the amount of a property that a person (not the bank) actually owns. For example, if you put a down payment of 20% on a $200,000 home and got a loan for the rest, your home equity is $40,000. Your equity will increase as you pay down the loan and as your property value increases. But it could decrease if you take out more loans against the property or if the home rapidly declines in value.

Escrow

A third party holds funds in escrow during the real estate transaction, releasing them at closing. Generally, this refers to earnest money funds. Some states have laws on the books requiring escrow account holders to pay interest on these funds, though banks are often exempt.

Examination of title

Before closing, everyone will want to make sure that the title is clear. Title companies research a property’s transfer of ownership through public records to trace its history and ensure there are no encumbrances that could affect the purchase.

Exclusive listing

When walking through a new listing agreement, it’s important to explain all of the different representation options. An exclusive listing gives one real estate agent a property listing and a certain amount of time to get the property sold. That agent is expected to find buyers and oversee the transaction during this period. This is a good topic to cover when you’re explaining commissions, percentages, and how they are split.

How to Get Listings in Any Market (Without Spending a Fortune)

F

Fair Credit Reporting Act

This one doesn’t get as much attention as the Fair Housing Act, but it was a game changer for the industry. Before the Fair Credit Reporting Act, consumers were not nearly as protected and abuse of personal data ran rampant.

Enacted in 1970, the Fair Credit Reporting Act ensures that files containing personal information gathered and held by consumer credit reporting agencies are handled fairly, accurately, and privately. It also gives consumers access to their own information.

Fair market value

The fair market value is essentially the price that the market is able to bear, borne out by the fact that both the buyer and seller agree upon it. Make sure your clients don’t confuse it with the appraised or assessed value.

It’s actually a legal term. Courts define it as “the price at which the property would change hands between a willing buyer and a willing seller, neither being under any compulsion to buy or to sell and both having reasonable knowledge of relevant facts.”

Price Reduction in Real Estate: A 5-step Guide for Agents

Fannie Mae

The colloquial name for the Federal National Mortgage Association, Fannie Mae is one of the most active sources of mortgage financing in the country. Fannie Mae is a government-sponsored enterprise that allows medium- to low-income families and individuals to obtain affordable mortgages.

Fee simple

This is a type of common property ownership in which there are no conditions or restrictions, and the property is owned absolutely.

FHA mortgage

FHA mortgages are government-backed property loans insured by the Federal Housing Administration. They differ from conventional loans in that the down payment and credit score requirements are lower. That’s why they’re especially popular with first-time homebuyers.

Fixed-rate mortgage

With a fixed-rate mortgage, the interest rate is set and does not fluctuate during the life of the loan. This gives the borrower the stability of knowing the monthly payments will stay the same over the course of the 15 or 30 years of the loan. If interest rates dip significantly, borrowers can refinance their loan but will have to pay closing costs.

For sale by owner (FSBO)

This is when the owner of a property publicly lists it for sale without the assistance of a licensed real estate agent. Agent slowly raises palm to forehead. Many FSBOs are hoping to save money by not paying a seller agent’s commission fee. But given the cost savings that agents typically bring to a transaction thanks to their marketing and pricing expertise, they probably won’t. Learn more about FSBOs and who pays the buyer’s commission with a FSBO in this HomeLight article.

Foreclosure

If a property owner stops paying their mortgage payments, usually for at least 90 days, the lender can start foreclosure proceedings. This can lead to a short sale, foreclosure auction, and/or the lender taking possession of the property.

Freddie Mac

Freddie Mac is the common name for the Federal Home Loan Mortgage Corporation, or FHLMC. It’s a privately traded, government-backed company that offers greater accessibility to mortgage loans and provides stability in the market.

H

Home equity conversion mortgage

A home equity conversion mortgage is a type of reverse mortgage offered by the FHA that allows the borrower to withdraw a portion of their equity in a property.

Home equity line of credit (HELOC)

This is a line of credit based on the equity one has in their property.

Home inspection

Whether it’s bats, creaky foundations, creative duct-taping, or prominently displayed naked photos of the homeowners, most agents have encountered something unexpected in this phase. If you need a few more examples, check out realtor.com’s Strange but True Tales From the Trenches.

Generally, a buyer will enlist the services of a licensed home inspector after the initial offer phase. The inspector will look for major (and sometimes minor) defects in a home that could impact the value. Inspectors usually look at the foundation, roof, plumbing, electrical systems, and HVAC.

26 Critical Questions to Ask Home Inspectors

Homeowner’s association (HOA)

Buyers looking at a home in a planned community need to know what an HOA is and why it’s important. An HOA is an entity that oversees the rules and regulations related to a planned neighborhood or multifamily building. They can also offer services to homeowners, manage shared property and common areas, ensure appearances are kept up, plan activities, and protect property values. Homeowners generally pay HOA fees each month. If they neglect to do so, the HOA can put a lien on the property.

HOAs have quite the reputation, but they’re not all bad. Or maybe they are. We appreciate Atlanta-based CPA Neal Bach’s list of his top 10 most amusing HOA stories. Our favorite is the HOA that mandated residents wear polo shirts and khaki pants when holding a garage sale. And yes, there absolutely was a fee for noncompliance!

Homeowners insurance

Clients will need to arrange property insurance before closing. That’s why it’s smart to start shopping around as soon as they are under contract. Homeowners are required by their lenders to obtain homeowners insurance, which protects both the owner and mortgage provider against calamities, natural disasters, and accidents occurring on the property. Insurance is generally folded into monthly mortgage payments. Be aware that certain areas may have special requirements, like properties in flood zones needing flood insurance.

I

IDX website

A real estate agent’s website is one of the most important marketing and lead generation tools in their arsenal, especially when they have IDX functionality. IDX, or internet data exchange, allows your website to “talk” to the MLS and keep up-to-date real estate listings right on your site. We have done extensive research and selected our top real estate website builders that include IDX to help agents select the best provider. Check out our roundup below:

The 8 Best Real Estate Website Builders for 2024

J

Judicial foreclosure

In many states, lenders must obtain a foreclosure ruling through the courts before commencing foreclosure proceedings.

Jumbo loan

A jumbo loan is one that goes over the “conforming loan limit.” That makes it ineligible to be backed by government-sponsored programs administered by Fannie Mae, the FHA, and Freddie Mac. The limit is based on local median home values. Jumbo loans generally require stricter qualifications, higher credit scores, and higher income or cash reserves.

L

Lead generation

Agents generate leads to keep their sales funnels full and ensure a steady pipeline of prospects and leads. Lead generation activities can range from cold calling to buying leads and everything in between.

The 11 Top Real Estate Lead Generation Companies 2024

Lease option

As the market cools and rates rise, this could be an attractive option for buyers who have found their dream home but are hoping rates will come down in the near future. A lease option is also known as a rent-to-buy. A property is leased for a determined monthly amount and can be purchased at any time during the lease for a specified amount of money.

Lender

In real estate, a lender is any individual or institution that provides financing to purchase a property, with the expectation that the amount will be repaid with interest.

The Best Hard Money Lenders of 2024 (Interest Rates, Fees & More)

Lien

We bet you have a lot of clients who think they understand this concept but could maybe use a refresher. A lien against a property means there is some unpaid debt where the property was used as collateral. This could tangle up the closing process if not properly handled. Liens can come from unpaid mortgages, construction bills, even HOA fees. A mortgage is also considered a lien.

Life cap

On an adjustable-rate mortgage, this is the maximum rate of interest that can be charged above or below the initial interest rate. Generally, the life cap of an adjustable-rate mortgage is 5% or 6%, although it could be higher. This means that even if interest rates rise more than that life cap, the borrower will not have to pay those rates.

Loan officer

A loan officer is a licensed official with a financial institution who is responsible for helping borrowers understand the mortgage process, choose a loan, apply for and receive it, and communicate with other transaction stakeholders. These are the people who should be answering all of your client’s mortgage-related questions.

Loan origination

This is the time period during which a financial institution reviews a borrower’s loan application. There is sometimes a loan origination fee, as the institution gathers information and data to assess the borrower’s risk.

Loan servicing

Servicing is everything involved in the administration and maintenance of a loan. It includes sending out statements; collecting, recording and tracking payments; managing escrow funds; and following up on unpaid debts. This is important for clients to understand because the company that they ultimately pay might be different from the institution from which they originally took out the loan (the originator).

Loan-to-value (LTV)

This is the ratio between the loan amount and the property value. To find the LTV, divide the loan amount by the value. A higher LTV denotes greater risk to the lender.

Lock-in period

A borrower must wait a certain amount of time before being able to pay off a loan in full. If a borrower does pay off a loan during the lock-in period, fees are usually involved. Make sure your clients don’t confuse this with a rate lock.

M

Mortgage

A buyer who can’t pay cash for a home will take out a loan, or mortgage, from a financial institution, using the property itself as collateral. In exchange, the borrower will pay back the loan regularly over a scheduled period of time and with interest. Remember, the mortgage guys are the professionals. When it comes to specific mortgage questions, be sure you’re referring your clients to qualified people.

Mortgage banker

A mortgage banker represents the financial institution issuing the loan and oversees each step of the process. Make sure your clients understand the difference between a mortgage banker and mortgage broker.

Got Clients With Interest Rate Questions? Share This!

Mortgage broker

A mortgage broker has access to multiple financial institutions. This way, they can shop around to find a mortgage with the best interest rates or deal for the borrower.

Mortgage insurance, aka private mortgage insurance (PMI)

Mortgage insurance protects banks against payment default. It’s often required by lenders if the borrower is putting down less than 20%.

Multiple listing service (MLS)

Like Zillow, but for real estate professionals, the MLS is a network of local lists that create a database of properties for sale.

N

Negative amortization

Negative amortization can happen when a borrower doesn’t put enough in their monthly repayments to cover the interest. In this situation, the total amount owed on the loan continues to increase.

No cash-out refinance

A borrower might use a no cash-out refinance to take advantage of a lower interest rate or to shorten the term of their mortgage. The borrower isn’t taking money out based on the equity of the property as they would in a cash-out refinance.

No-cost mortgage

In a no-cost mortgage, the lending institution pays all of the closing costs in exchange for the borrower paying a higher interest rate. This benefits the lender in that they can then sell the mortgage on a secondary market for more because of the higher rate. It benefits a borrower who plans on staying in a property for less than five years. They save the closing costs and aren’t saddled with a higher interest rate for 15 or 30 years.

Note rate

Also called nominal rate, this is the amount of interest set for a loan used to calculate the monthly payment on a mortgage. Clients often confuse the note rate with the annual percentage rate. But the APR is actually used to compare what it would cost for a specific loan with a certain lender, adding all their particular fees in.

What Should You Not Say When Selling a House: An Agent’s Guide

O

Open listing

A seller who uses an open listing doesn’t have an exclusive agreement with an agent. This means that any agent can compete to find a buyer and receive the commission. Similar to a FSBO, an open listing might save the seller some money, but we all know it comes with a lot of headaches.

Without a real estate professional, the seller doesn’t have someone who can provide advice and help move the transaction along. Agents might also be less motivated to market the property since they are not guaranteed a commission.

The 10 Best FSBO Scripts (+ Why They Work)

Original principal balance

The original principal balance is the total amount owed on a loan before any repayment begins. This is the number clients will see before they pay their first monthly payment, though it generally does not have the escrow balance applied to it.

Origination fee

A borrower will pay an origination fee to the lending institution to cover the cost of processing a mortgage loan. Clients might be surprised to learn that an origination fee is typically between 0.5% and 1.5% of the total loan amount. This means an origination fee on a $250,000 loan could be as high as $3,750.

Owner financing

If a buyer secures a mortgage directly from the seller, it’s considered owner (or seller) financing. The borrower generally avoids the fees, requirements, and rates associated with conventional loans and works out a legal and binding contract with the seller. There are also several advantages to the seller. They can typically set their own loan terms and sell the property as-is. Also, it all usually happens much more quickly than waiting on slow-moving financial institutions.

Of course, there is risk involved, but sellers can often retain the deed until the debt is paid off. For buyers who struggle with good credit or putting together a 20% down payment, seller financing can open a lot of doors.

P

Pay-at-closing leads

Maybe you want leads, but you don’t have the budget to splash out on buying them right now. With a pay-at-closing lead gen model, you can obtain and work leads and then only pay when they close on a property. Just note that the cost is usually pretty substantial, even as much as 35% of the commission.

Top 8 Sources for Pay at Closing Real Estate Leads

Pending

This definitely gets confusing for clients poking around on Zillow, Redfin, and even the MLS. What’s the difference between active, active-contingent, pending, and all of the other terminology? If a sale is labeled “pending,” all of the contingencies on the sale have been met and it is moving toward closing. Chances are very good that this sale will close. If not, the buyer may be at risk of losing their earnest money.

Per diem fees

Per diem fees are paid by the borrower for every day a loan is scheduled to close but does not. To calculate the per diem, multiply the loan amount by the interest rate (as a decimal) and divide that total by 365. The fees are generally paid to the lender at closing.

A seller could also add a per diem clause in the contract. For example, if a buyer doesn’t close on a specified date, they might be required to pay a certain amount per day to cover utilities, insurance, HOA fees, or taxes.

Principal, interest, taxes & insurance (PITI)

This figure calculates monthly housing costs by adding up principal, interest, taxes, and insurance. PITI represents the total amount owed by a borrower every month. Many recommend borrowers keep PITI to less than (or equal to) 28% of their total monthly income. This is helpful for clients to know when they are considering how much house they can afford.

Planned unit development (PUD)

A PUD is a grouping of residential buildings. It could be made up of townhouses, condos, or single-family homes, and generally includes common areas such as pools, tennis courts, playgrounds, and parking. PUDs almost always have HOAs and associated fees.

It’s crucial that clients looking at PUDs understand the covenants, rules, regulations, and costs involved. For example, a client looking for a home where they could also host exercise classes for paying customers might run into trouble with a PUD’s HOA rules about running a business out of a home. And make sure they’re aware of any required dress code when holding a garage sale.

Pocket listing

A pocket listing is a property that’s being marketed quietly, in back channels. It can benefit sellers who value privacy or want to test the waters before listing publicly.

What should you do when a client asks for a pocket listing? Pocket listings are risky in that there is a lack of transparency that could end up limiting the number of potential buyers. This also makes pocket listings controversial, to the point where the National Association of Realtors (NAR) enacted the MLS Clear Cooperation Policy. This states that agents must put a pocket listing on the MLS within one day of any kind of marketing.

Pre-approval

Again, this is all really in the purview of the mortgage experts. However, your clients need to know the difference between pre-approval and prequalification (see below). After all, having a pre-approval letter from a lender can go a long way in giving a seller confidence when looking over an offer.

After a borrower applies for a loan, a lender will grant them pre-approval for a certain amount based on verifying all of the information gathered. It’s important for your clients to understand that pre-approval does not guarantee a mortgage loan.

Predictive analytics

A predictive analytics company pulls together millions (if not billions) of data points from multiple sources in order to forecast the future. In real estate, common data sources include demographics, property, event data, and behavioral trends. This forecasting can influence, and even direct, strategic decisions, but it can also help agents hyper-target their marketing and lead generation activities on the prospects most likely to buy or sell in the next year.

Predictive Analytics in Real Estate: Best Practices & Software for Agents

Prequalification

Prequalification is the very first step in the mortgage loan process. A financial institution will prequalify a borrower for an estimated amount. It’s not as thorough a process as pre-approval, so it’s important to remember that this is even less of a guarantee of a loan.

Prime interest rate

With everyone’s eyes focused firmly on interest rates, it’s important to know what it all means. A prime interest rate is what financial institutions use as a basis to determine rates for mortgages, credit lines, and even credit cards.

Each bank has its own prime interest rate, based on the Federal Reserve’s federal funds rate. While the prime interest rate is not the best or most competitive rate, it’s the one published publicly that can be adjusted based on individual loans. This is where clients with good credit, high down payments, and low debt-to-income ratios can negotiate for better rates.

Principal

Principal is one of those words that can mean different things to different people, probably because it all depends on the context.

In lending, principal is the total amount of money borrowed that must be paid back with interest.

In real estate, the principal could also refer to a party (the buyer or seller) who has authorized an agent to act on his or her behalf.

It could also refer to the managing broker in a brokerage, or the individual who’s ultimately legally responsible for overseeing transactions.

Probate

This is the process of reviewing a deceased person’s estate and will and administering the transfer of property. Probate can take place whether or not the deceased had a will in place.

Proof of funds

Clients should be aware that proof of funds is different from pre-approval from a lending institution. Buyers with all-cash offers still need a proof of funds letter, but for the entire amount.

A proof of funds letter lays out the financial situation of the buyer, demonstrating their capacity to buy a property. It should show that the buyer has enough cash on hand to cover the down payment and closing costs. These funds must be liquid, not stocks or bonds.

A proof of funds form can be furnished by a bank, or you can use this simple proof of funds template from realtor.com.

Purchase agreement

Once an offer is accepted and all of the parties have signed, it becomes a contract, or a purchase agreement. It’s important for buyer clients to understand that if they submit an offer, it becomes a binding contract once the seller agrees and signs.

A purchase agreement outlines the terms and conditions of a sales contract. It affirms the buyer’s intent to purchase the property and the seller’s intent to convey it to the buyer. It also outlines the general agreed-upon terms, such as the purchase price, contingencies, closing date, and earnest money details.

R

Rate lock

Imagine a client submits an offer, and then rates increase exponentially in the period between the contract being signed and the closing date. It could throw off the entire deal.

Luckily, borrowers can lock in an interest rate for a certain amount of time. This protects that rate against fluctuations in the market in the time between making an offer and the closing date. Clients should check with their mortgage specialist to see what time frames are available and the fees associated with them.

This Free Download Helps Your Clients Understand Rate Lock

Real estate agent

You know who you are! Clients might be interested to know that you have specific education requirements, are licensed by the state, and must follow certain laws. And if you’re a member of NAR, you’re bound by a very stringent code of ethics.

How to Get a Real Estate License in 5 Simple Steps

Real-estate owned (REO)

Properties that have been possessed by a lender after the borrower has defaulted on a loan and a short sale or auction was unsuccessful are called real estate (or bank) owned.

Real Estate Settlement Procedures Act (RESPA)

The Real Estate Settlement Procedures Act of 1974, or RESPA, is a piece of legislation that protects consumers. It requires lenders to be transparent by providing timely disclosures of the scheduling and costs of a real estate transaction. It also prohibits kickbacks and inflated fees and places some limitations on the uses of funds in escrow.

Before RESPA, mortgage lending felt like the Wild West. Consumers could easily find themselves at the mercy of bad actors who charged exorbitant fees, required referrals, and promised one thing but delivered something very different.

If your clients are concerned about the relationship between real estate professionals and bankers, you can assure them that agents and mortgage lenders are governed by RESPA regulations.

Realtor

Many think this term is synonymous with agent, but it’s not. A Realtor is a real estate agent who is a dues-paying member of the National Association of Realtors. NAR members are held to a high standard of professionalism and adhere to a strict code of ethics.

Refinance

If a borrower takes out a new loan on the same property, it’s called a refinance. The debt owed remains the same, but generally under better terms, such as a lower interest rate, smaller payments, or a shorter loan term.

Right of first refusal (ROFR)

Giving someone the right of first refusal means that they have the opportunity to submit an offer on a property before anyone else. The seller can charge whatever price they want and the potential buyer can offer whatever they think is fair. It doesn’t mean the offer will be accepted, but it does give the potential buyer an advantage.

Right of ingress or egress

The right of ingress is one’s right to enter their property, and egress is to exit their property. You’re likely to hear these terms mentioned when there is an easement on a property.

S

Sale-leaseback

This occurs when a seller and a buyer close on a property, but the seller needs more time to vacate the property. The seller can then lease back their former home from the buyer and pay rent for a specified period. This can be a great negotiation point between buyers and sellers if time is an issue.

Second mortgage

Borrowers can take out a second mortgage on a property using the property as collateral. The first mortgage remains in effect, and would be the first loan to be paid off if there is any default. Generally, second mortgages have high interest rates and are for less money than the first mortgage.

Secured loan

A mortgage is a type of secured loan, where one uses collateral—in this case a property—to secure funds. Loans can also be secured by cars and other high-value items.

Short sale

If a borrower is behind on payments and in a dire financial situation, a lender might allow a short sale of the property. In such a case, they generally accept less than is actually owed on the mortgage.

Buyers are often interested in short sales because they can mean a good deal on a property. But short sales are incredibly complicated. And the process is anything but short.

How Smart Investors Decipher & Respond to Real Estate Market Cycles

Staging

Seasoned agents know that staging can really help a home shine, especially if the property is vacant. Applying a neutral, trendy look can help prospective buyers visualize themselves living in the house and can even increase the sales price.

Bringing in new design elements and storing owners’ current furniture can be pricey. But many staging companies assure sellers that they will recoup those costs in the sale of the home.

If staging is not an option, consider tactful ways of suggesting that the owners declutter. Or just follow this list of clever staging tips!

T

Termite report/inspection/letter/bond

Imagine your clients purchase a home and, as they walk through the kitchen, their feet go through the floorboards because termites have been snacking on the wood. Termites can cause catastrophic damage. That’s why many lenders require proof that a property has been inspected for termites and termite damage.

Banks may also require that the home be under a continuous termite bond. This shows that the home is regularly inspected and treated for termites by a professional pest control company. If termites are found, there are options of remediation. But the process is often pretty dramatic, like tenting the entire house and pumping in toxic gas.

Title

A title is one’s legal right to a property, to use it however one wants, and to transfer it how and when and to whomever one wants. It is different from a deed, which legally shows who is the property owner.

Title insurance

Let’s say you’re a buyer who purchases a property after conducting a title search, believing the title to be clean. Two weeks later, a fourth cousin, twice removed, of a little old lady who owned the house 74 years ago shows up on the porch saying you’re living in his inheritance. Title insurance has got you covered—it protects a property owner and a lender against claims on a property title.

Title search

When purchasing a property, most buyers will hire a lawyer or title company to comb through public records to follow the transfer of the title across the decades. This ensures that the title is clean and free of any liens or encumbrances. Individuals can conduct their own searches, but that’s not usually recommended. Generally, title insurance companies accept 30 years of record, which is good news for owners of historic homes.

Transfer of ownership

This is a fancy way of explaining the conveyance of the deed and title from the seller to the buyer at closing.

Transfer tax

A transfer tax is essentially a fee charged by the state, county, or municipality to handle transferring the title. Clients will expect you to know the rates and if there are any applicable exceptions, as will the writers of your state’s real estate licensing exam.

Almost everywhere, the seller pays the transfer tax. The fee is based on the value of the home and can be calculated in increments or as a percentage. For example, in South Carolina, the combined state and local fee is $1.85 per every $500 increment of the total sale price.

U

Under contract

If a buyer and seller have agreed on a price and terms and signed a contract, then the property is under contract. However, all contingencies have not yet been met, and the closing has not taken place. Once the contingencies are met, the property is considered pending and the sale will most likely go through.

Again, this is a time of great uncertainty, and while an agent can control a lot, you can’t control everything. Stay diligent, stay vigilant, stay calm. And make sure you take your phone off silent.

14 Real Estate Testimonial Examples to Inspire Your Referral Marketing

USDA loan

USDA loans are backed by the Department of Agriculture and tend to have lower mortgage insurance requirements than other government-backed loans. They also don’t require a down payment. The catch is that the property must be in suburban or rural areas to qualify.

Free Download: Loan Questions That Could Save Your Clients Money

V

VA mortgage

A VA mortgage is managed by the Veteran Benefits Administration and offers a guarantee for some or all of a mortgage issued by a private financial lender. This guarantee allows servicemen and women, veterans, and surviving spouses access to better loan terms. Those who qualify can learn more and apply for a VA mortgage loan here.

How to Become a Successful Military Relocation Professional (MRP)

Bringing It All Together

You made it through all 136 real estate terms! Ensuring that you know and can explain these definitions will go a long way in helping your clients. No matter where you are in your real estate career, we hope this list of crucial real estate terms and definitions was helpful, a good refresher, and maybe even enlightening. How about that Garn-St. Germain Depository Institutions Act? Great anecdote for cocktail parties!

Did we miss any of your favorite terms? Have any definitions to add? Be sure to leave a comment below!

Add comment