When traditional bank loans are unavailable for your investment projects, obtaining funds from hard money lenders is a great alternative option. Hard money lenders typically offer short-term loans backed by real estate collateral. These loans are helpful in situations where you need quick funding due to a new investment opportunity, property flip projects, or when you’re just unable to obtain conventional lending. I’ve scoured the web to find the six best hard money lenders for your investment needs.

- Kiavi: Best for rapid financing for quick property flips

- RCN Capital: Best for investors requiring large loan amounts

- Lima One Capital: Best for loan products for every type of investment strategy

- Groundfloor: Best for new investors with crowdsourced loan opportunities

- The Investor’s Edge: Best for personalized investment strategies through one-on-one consultations

- New Silver: Best for tech-savvy investors seeking fast, data-driven loan approvals

| Type of Software | Best for | Available markets | Learn More |

|---|---|---|---|

| Obtaining quick financing for your projects | 32 states plus Washington, D.C. | Kiavi ↓ |

| Investors needing large loan amounts | All states except AK, NV, ND, SD, and VT | RCN Capital ↓ |

| Loan products for every type of investment strategy | 46 states plus Washington, D.C. | Lima One Capital ↓ |

| New investors with crowdsourced loan opportunities | Nationwide | Groundfloor ↓ | |

| Investors that need 1-on-1 assistance with their projects | 39 states | The Investor’s Edge ↓ |

| Investors needing instant loan approvals | 39 states | New Silver ↓ |

| Type of Software | Best for | Available markets | Learn More |

|---|---|---|---|

| Obtaining quick financing for your projects | 32 states plus Washington, D.C. | Kiavi ↓ |

| Investors needing large loan amounts | All states except AK, NV, ND, SD, and VT | RCN Capital ↓ |

| Loan products for every type of investment strategy | 46 states plus Washington, D.C. | Lima One Capital ↓ |

| New investors with crowdsourced loan opportunities | Nationwide | Groundfloor ↓ | |

| Investors that need 1-on-1 assistance with their projects | 39 states | The Investor’s Edge ↓ |

| Investors needing instant loan approvals | 39 states | New Silver ↓ |

Kiavi: Best for Rapid Financing for Quick Property Flips

|

|

|---|---|

Pros | Kiavi Rates & Terms

|

Cons |

|

Why I Chose Kiavi

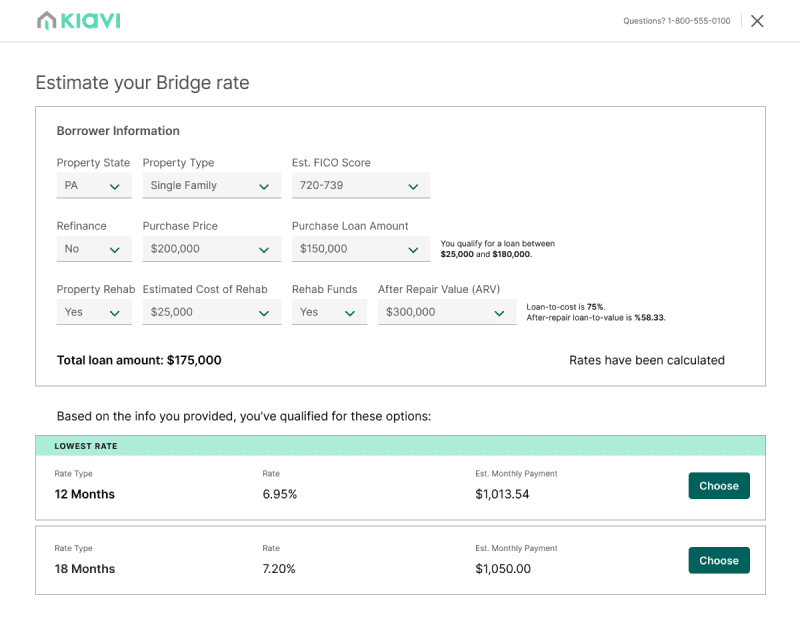

I chose Kiavi as one of the best hard money lenders for rapid financing for quick property flips because of their efficient loan processing. They specifically offer fix and flip loans with rates as low as 9.25%. Because of their swift financing process, inventors can compete with all-cash buyers on new purchases. Their application process bypasses tedious paperwork like pay stubs and W-2s, as their technology can cut through the clutter and get you approved quickly.

Additional Features

- Prequalification: With just a soft credit pull, real estate investors can prepare to make quick offers on any opportunities that arise.

- Flexible loan amounts: With loans up to $3 million, Kiavi can accommodate small renovations and large-scale projects.

RCN Capital: Best for Investors Requiring Large Loan Amounts

|

|

|---|---|

Pros | RCN Capital Rates & Terms

|

Cons |

|

Why I Chose RCN Capital

I selected RCN Capital because it’s one of the hard money lenders for real estate that offers loans up to $2.5 million. This amount is significantly higher than many other hard money loan lenders, making it ideal for investors handling large-scale developments or multiple rental properties. RCN determines the maximum loan value based on the loan program and the value of the real estate asset as collateral. Unlike more tech-forward lenders, RCN requires a typical application process to include credit reports, background checks, bank statements, property appraisals, etc.

Additional Features

- Rehab budget builder: This tool is available to help investors analyze their investments to understand cost, risk, ROI, etc.

- Video Library: It includes up-to-date videos that offer market updates, investment tips, and motivational content.

Lima One Capital: Best for Loan Products for Every Type of Investment Strategy

|

|

|---|---|

Pros | Lima One Capital Rates & Terms

|

Cons |

|

Why I Chose Lima One Capital

Lima One Capital’s extensive range of loan products makes it the best hard money lender for supporting every type of investment strategy. Even within each loan product, like fix and flip loans, there are multiple financing options for flipping, fix-to-rent, and bridge loans. They also provide loans for rentals, new construction, multifamily properties, and short-term rentals. In addition, they offer investors a variety of loan terms and structure options like loans from 13-24 months, nonrecourse, single loans, and portfolios. Best of all, investors only have to pay interest on what they draw and not on unused funds.

Additional Features

- Case studies: Detailed case studies on their website illustrate the strategies, financial figures, challenges, and outcomes of real-world property investments.

- Podcast: A podcast covers various topics relevant to real estate investing and provides ongoing education and industry insights in an easily accessible audio format.

Groundfloor: Best for New Investors With Crowdsourced Loan Opportunities

Pros | Groundfloor Rates & Terms

|

Cons |

|

Why I Chose Groundfloor

Groundfloor is ideal for new investors because of the lack of transaction experience required. They are one of the national hard money lenders that allows investors to start with smaller amounts and gain experience in real estate financing. The trade-off for a lack of investor experience is that Groundfloor will require a higher credit score. They provide a comprehensive education hub for investors to access videos on growing wealth and budgeting their finances. I also found that their crowdfunding investment options offer a great opportunity for new investors to invest in real estate without taking on the purchasing burden.

Additional Features

- Blog: A regularly updated blog provides insights, updates, and educational content related to real estate investing and personal finance.

- Debt service coverage ratio (DSCR) loans: Long-term loans are available based on cash flow generated by the property instead of loan approvals based on the investor’s income.

The Investor’s Edge: Best for Personalized Investment Strategies through 1:1 Consultations

|

|

|---|---|

Pros | The Investor’s Edge Rates & Terms

|

Cons |

|

Why I Chose The Investor’s Edge

I am a fan of The Investor’s Edge as the best for personalized investment strategies due to their focus on partnering with investors and their projects. They offer free one-on-one consultations to help investors identify which investment strategies will help them reach their financial goals. Beyond the consultations, the team at The Investor’s Edge team will help investors identify, fund, and sell their properties. I also appreciate the availability of informative courses tailored to home and land flipping for new investors.

Additional Features

- Gap financing: It is a type of short-term loan available to investors that covers the difference between the total funding needed for a project and the principal amount already secured.

- The Investor’s Edge Software: It is a comprehensive tool designed for investors to efficiently perform real estate market analysis, property valuation, and investment strategy planning.

New Silver: Best for Tech-savvy Investors Seeking Fast, Data-driven Loan Approvals

Pros | New Silver Rates & Terms

|

Cons |

|

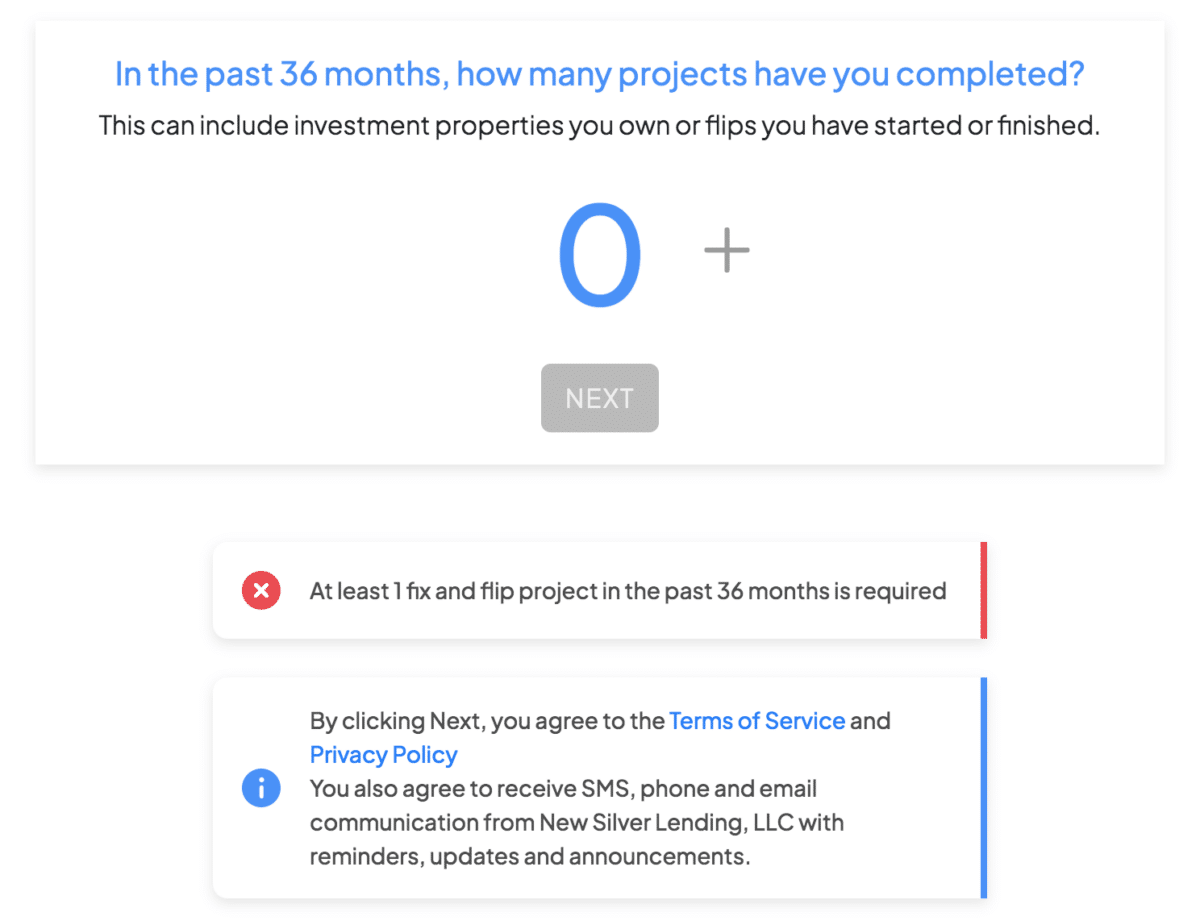

Why I Chose New Silver

New Silver is one of the hard money loan lenders ideal for tech-savvy investors because of its efficient, AI-driven loan approval processes. Investors can get instant online approval in just five minutes and close in as little as five days. Loans secured through real estate collateral only require a soft credit pull in addition to the property’s value. They do not need income verification for loan approval. I appreciate the platform’s focus on streamlining the lending process, which minimizes paperwork and accelerates the timeline from application to funding.

Additional Features

- Advantage program: It has enhanced loan terms and rates to repeat borrowers who have successfully completed previous projects with New Silver.

- Fintech scholarship: It has an initiative to support students pursuing studies in financial technology-related fields.

What Is a Hard Money Lender?

Hard money lending companies provide specialized financing where real estate property is pledged as collateral. They are much different from a traditional lender, such as a bank, which first and foremost bases its decisions on a borrower’s credit history and income when deciding whether to approve a loan.

Hard money lenders focus primarily on the property’s value and potential. This focus on asset value, not creditworthiness, makes hard money loan lenders quite applicable in real estate ventures where time is of the essence to maximize new investment opportunities.

Pros & Cons of Hard Money Loans

Hard money loans are one of the most popular financing options for real estate investors because they provide quick turnaround on projects where traditional funding may not be possible. The table below identifies all the pros and cons related to hard money loans that investors should be aware of when considering this financing option:

|

|

|

|

|

|

|

|

|

|

|

|

How to Know if You Need a Hard Money Lender

Knowing whether a hard money lender is the proper fit for your real estate financing involves many considerations. Most hard money loans are designed for unique situations or circumstances that traditional funding just can’t handle. The following is a closer look at situations where you should consider a hard money lender:

- Quick funds are needed: You require quick financing to secure a real estate deal before potential competitors.

- Credit issues: Traditional financing isn’t an option due to credit issues or unconventional income that doesn’t satisfy typical bank requirements.

- Short-term financing: For projects like fix-and-flips or bridge loans, you need short-term financing.

- Investment opportunities: You encounter a real estate investment opportunity that requires immediate action that conventional funding sources cannot meet.

- Renovation projects: You need financing for purchasing properties that require significant repairs that traditional banks may not finance because of their condition.

How to Choose the Best Hard Money Lenders

The right lender can make or break your investment. Keeping these factors in mind will put you in a better position to know when you really need a hard money lender and how to be sure you are selecting an appropriate one for your specific financial and project goals. This evaluation allows you to work with the best lender possible for the most optimal terms possible for your investment strategy. Here is how to choose the right hard money lender:

- Evaluate lender reputation: Research the lender’s track record, customer reviews, and industry reputation to ensure they are reliable and fair.

- Understand the terms: Fully comprehend all loan terms, including interest rates, fees, loan-to-value ratio, and repayment schedule.

- Assess the speed of funding: Since time is often critical, assess how quickly the lender can process and fund the loan.

- Professional advice: Consider consulting with a financial advisor or real estate professional to help navigate the process and select the best lender for your specific needs.

- Compare multiple offers: Don’t settle for the first lender you meet. Compare different offers to find the best terms and rates.

- Check for transparency: Ensure the lender is transparent about all costs, fees, and any penalties associated with the loans.

Methodology: How I Chose the Best Hard Money Lenders

To find the best hard money lenders of 2024, I devised a rigorous methodology focused on the most critical factors to create an unbiased review. I reviewed various lenders against multiple key factors to ensure I viewed them through the lens of what would be most important to a real estate investor. The detailed analysis then isolated lenders that support good, solid financial solutions and blend well with various investment strategies and goals.

Here are the key factors considered:

- Interest rates and loan terms: Assessed the competitiveness and flexibility of each lender’s offerings.

- Speed of loan processing and funding: Evaluated how quickly each lender processes and disburses funds, a crucial factor for time-sensitive investments.

- Lender reputation: Examined customer reviews and industry feedback to gauge each lender’s reliability and overall customer satisfaction

- Transparency: Focused on how openly each lender communicates fee structures and loan conditions, ensuring no hidden costs exist.

- Geographical coverage: Considered the availability of services across different regions to accommodate investors in various locations

- Target audience suitability: Analyzed which types of real estate investors (e.g., fix-and-flippers, buy-and-hold investors, and commercial developers) each lender best caters to based on their product offerings and specialty areas

Frequently Asked Questions (FAQs)

What are the typical interest rates for hard money loans?

Hard money loan interest rates are usually higher than conventional bank loan interest rates and typically range from 10% to 15% or more, depending upon the lender’s view of risk, property location, and the borrower’s financial situation. The higher rates reflect the increased risk that hard money lenders take by focusing on property value over borrower creditworthiness and the speed with which they provide funds.

How quickly can I receive funding from a hard money loan?

One major advantage associated with hard money loans is that processing is very quick. Usually, the funds are available to the borrower within a week or two of applying. This is possible because the value of property is checked against extensive credit checks with financial documentation, and hence, it can be used best in urgent real estate transactions.

What are the typical financing terms of a hard money loan?

Hard money loan terms are much shorter than most bank loans. The average term is usually six months to a few years. This duration is commensurate with common usage for such loans in quick-turnaround investments, such as fix-and-flips. Most hard money loans also have interest-only payments with a balloon payment at the end of the term when the property would presumably be sold or refinanced to more traditional financing.

Your Take

Investors should look for the best hard money loans that fit the needs of your project and financial goals. Consider a lender that offers flexible terms of the deal, transparent structures of the fees charged to the investor, and competitive rates of interest. Additionally, the lender should have an impressive, reputable status in the industry, characterized by positive testimonials from clients, with reliable transactions that give value to the money. The right hard money lender will do more than just finance an investment. They will also support the investor’s overall strategy and want to contribute to their success.

Add comment