For real estate agents new to earning commission-based or 1099 income, navigating the tax landscape without prior withholding taxes can seem overwhelming. However, maximizing tax write-offs for real estate agents is vital to reducing your overall tax burden. Deductible expenses—such as home office costs, vehicle expenses, marketing investments, and professional fees—can significantly lower taxable income. My guide will help diminish your fear about what you must do so that Uncle Sam doesn’t hit you with a hefty bill come tax time.

What Are Real Estate Agent Tax Deductions?

Individuals and businesses are taxed at a certain percentage defined by their real estate taxable income. To reduce the amount that you are taxed, you want to lower your taxable income as much as possible by deducting certain expenses.

For expenses to qualify as real estate agent deductions, they must generally be considered necessary and ordinary within the business context. For example, if an independent farmer were to itemize their tax deductions, then their animal feed cost would be deemed necessary and ordinary. The IRS sets specific criteria for what can be deducted for a business based on profession and expense type.

Why Should Real Estate Agents Claim Tax Deductions?

Most agents are provided with a 1099 tax form, which means not only is your commission not instantly taxed, but you will also be considered a nonemployee and pay self-employment taxes on all sources of income. Therefore, you want to maximize as many tax deductions for real estate agents as possible to lower your overall tax burden.

Agents and brokers often incur various expenses related to their business activities, such as traveling to properties, marketing listings, and maintaining an office. By leveraging the available real estate agent tax deductions, agents can ensure that they are not overpaying on their taxable income.

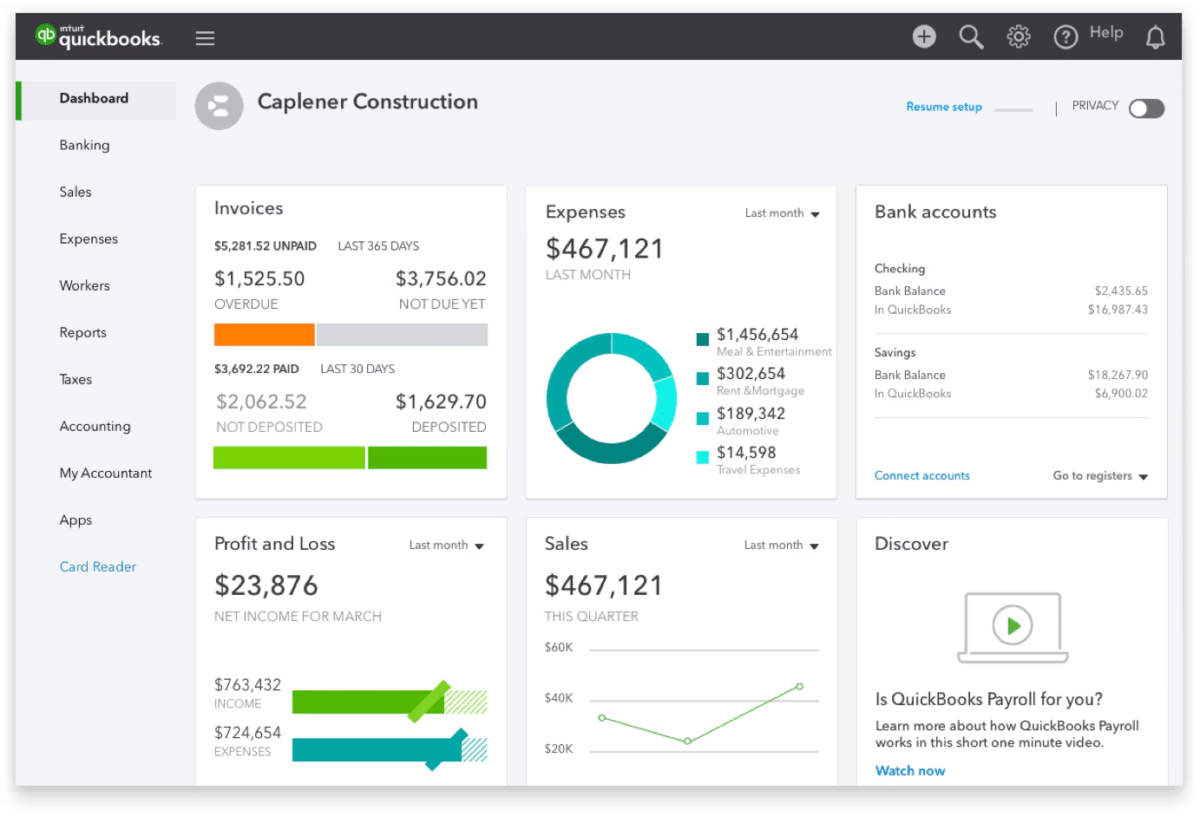

QuickBooks is a powerful tool that can significantly aid real estate agents in managing their finances and tracking tax deductions efficiently. This software allows agents to categorize expenses, monitor income streams, and store receipts digitally. Keeping precise records through QuickBooks ensures that all deductible expenses are accurately captured throughout the year. This can be especially helpful when preparing for tax season, as agents can quickly run detailed financial reports that provide a clear overview of potential deductions.

15 Realtor Tax Deduction Items

Real estate agents can benefit from understanding and using various realtor tax deductions specific to the real estate business. These deductions are tailored to offset the costs of real estate activities and include expenses for donations, continuing education, and home offices. By taking advantage of these opportunities, agents can reduce their taxable gross commission income and lower their tax liability.

So, if you’re wondering, “What can real estate agents write off?” here is a list of the top 15 real estate agent tax deductions every agent should know about:

1. Home Office Expenses

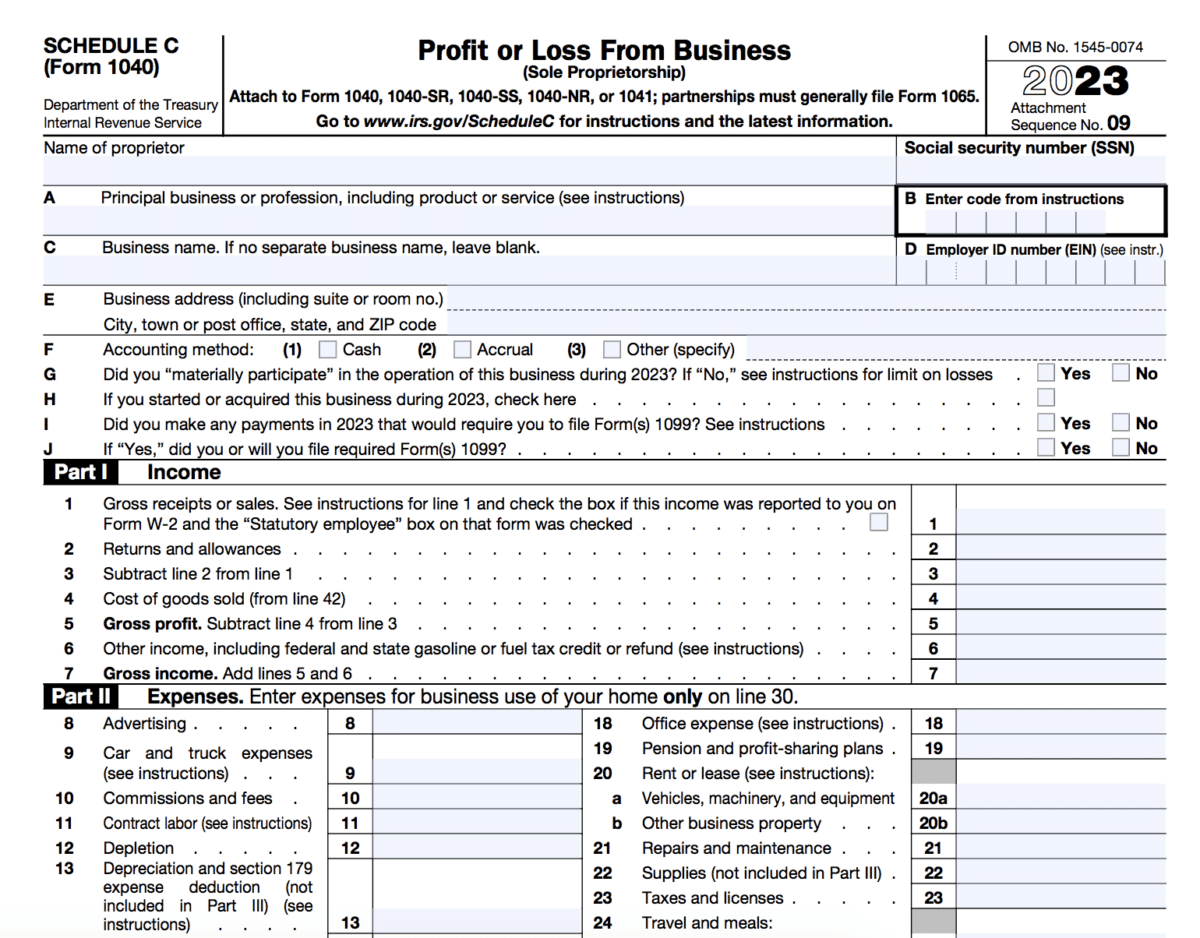

Home office expenses added on Schedule C, Line 18, allow real estate agents to deduct costs associated with maintaining a home office if it is their principal place of business. These deductions can include a portion of rent or mortgage, utilities, insurance, and office maintenance. In 2024, agents can choose between a standard deduction of $5.00 per square foot (a maximum of 300 square feet) and itemizing actual expenses based on the percentage of the home used for business.

2. Vehicle Expenses

Suppose an agent uses a car for business purposes. In that case, they can use a vehicle deduction on Line 9 of Schedule C. This deduction is only available if you use your car exclusively for business. You can deduct the vehicle cost, mileage, gas, and any repairs for up to $28,900. However, if used for personal and business purposes, you can only deduct the costs associated with the portion used for business by considering the business mileage. There is no cap on how many miles an individual can deduct.

3. Marketing & Advertising

This deduction includes all costs related to marketing and promoting a real estate business, like digital advertising, print ads, billboards, and promotional materials. These expenses are 100% tax deductible, so agents can deduct all costs of marketing their business. Make sure to include this deduction on your Schedule C, Line 8.

4. Professional Fees

Agents can deduct fees paid for professional services related to their real estate activities on Schedule C, Line 17. These services include payments to lawyers, accountants, business consultants, and other specialists who provide advice and services that help maintain or improve the business. As mentioned above, these real estate expenses must also be considered “ordinary and necessary” to be deductible.

5. Professional Development & Training

Costs incurred for education and training that enhance a real estate agent’s skills and knowledge are fully deductible on Schedule C, Line 27a. These costs may include educational activities such as seminars, workshops, specific real estate designations, and courses relevant to the real estate industry. According to H&R Block, agents must be prepared to prove that these educational activities will help maintain or improve the business.

6. Continuing Education

Real estate agents will need to complete continuing education to maintain licensure. Although slightly similar to the professional development and training real estate salesperson tax deductions above, expenses for required continuing education will fall under the requirement from the IRS that it is an expense required by your employer or by law to keep your current job. However, the IRS specifies that such education expenses imputed on Schedule C, Line 27a, must not qualify the agent for a new trade or profession, ensuring that the education is directly related to their existing role.

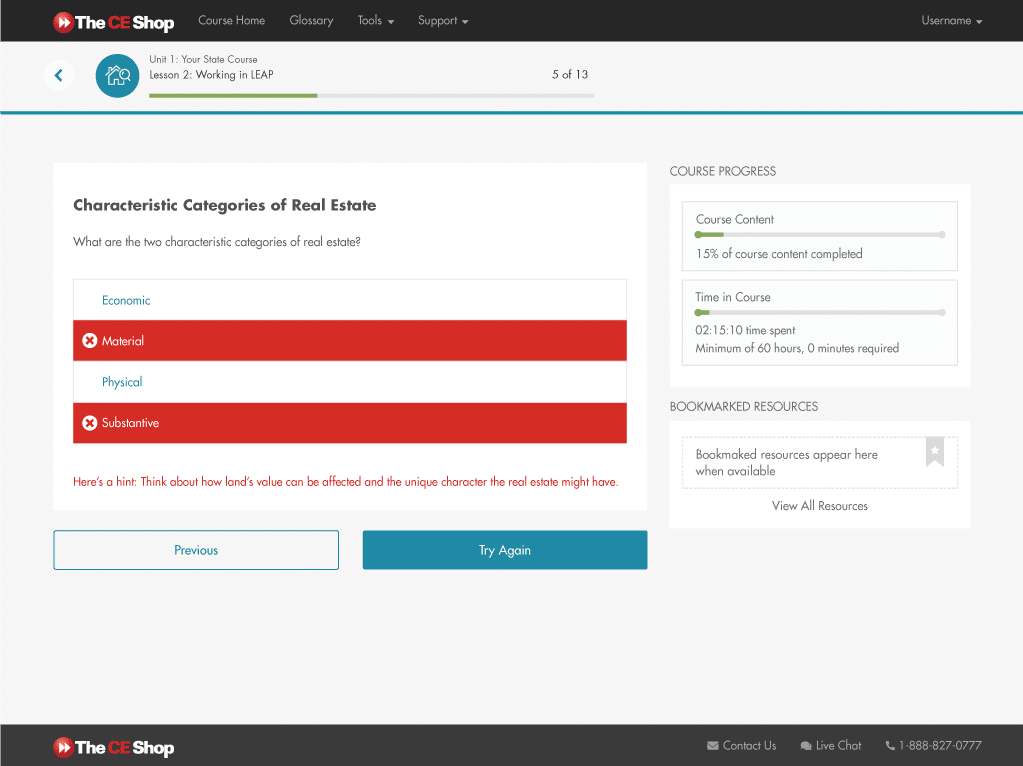

Agents who need to renew their licenses will be required to take continuing education courses. The CE Shop is a great option because of its LEAP learning platform and online format. The platform includes features like progress tracking and flexible online access, allowing agents to learn at their own pace and schedule. Whether you want to expand your expertise or simply keep up with mandatory education credits, The CE Shop equips agents with the tools needed for success.

7. Office Supplies & Equipment

Real estate agents can fully deduct the costs of business supplies and equipment essential for their business on Schedule C, Line 18. Items include everything from high-tech items—like laptops and cell phones—to everyday office supplies—such as paper, pens, and staplers. Keep detailed records and receipts of these purchases to maximize your deductions at the end of each year.

8. Travel Expenses

Travel expenses for business purposes are tax-deductible for real estate agents and documented on Schedule C, Line 24a. Deductible travel expenses can include visits to properties, client meetings, or industry conferences. Agents can claim costs associated with transportation, lodging, and other necessary travel-related expenses directly related to conducting business activities.

9. Meal expenses

Taking out clients for a meal or attending business-related meals can be partially deducted. Agents can deduct 50% of the total costs as a tax deduction. It’s best practice to keep the receipts and write down who you had a meal with and what it was for as a record if questioned in the future. This deduction can be recorded on Schedule C, Line 24b.

10. Real Estate License & Dues

On Schedule C, Line 23, costs related to maintaining a real estate license and dues paid to real estate boards or your brokerage are deductible. Since these costs are usually due annually, it should be easy for agents to remember to include them in their tax filings.

11. Professional Insurance Premiums

Some agents must maintain insurance premiums like professional liability insurance, also known as errors and omissions (E&O) insurance. The costs for the insurance premiums are considered necessary business expenses and, therefore, allowed as a business tax deduction to be added on Schedule C, Line 15.

12. Health Insurance

Most self-employed real estate agents are not provided health insurance through their brokerages and must secure their own policies. The health insurance premiums can also cover spouses and dependents. The expense is tax deductible when added to Schedule C, Line 14, and can offer significant tax relief due to the high cost of healthcare.

13. Desk Fees

Some brokers will require agents to pay desk fees for office space, resources, and support services. Sometimes, agents must pay out of pocket or deduct the fees from their commissions. If the fees are deducted from commissions, agents need to remember that this expense is still incurring and remember to document it on Schedule C, Line 10.

14. Professional Memberships

Fees for memberships in professional organizations like the National Association of Realtors, which is $156 per member in 2024, are deductible as they are required to perform real estate activities. This expense can be documented in Schedule C, Line 27a. Professional memberships geared towards recreation, pleasure, or social purposes do not fall under this category and are not tax deductible.

15. Charitable Donation

The charitable donation tax deduction isn’t specific to real estate agents but must be considered. For an agent to use this tax deduction, the charity must be an IRS-recognized nonprofit organization. Donations may include cash gifts and donations of goods or services. Proper documentation, such as receipts or acknowledgment letters from the charity, is essential for claiming these deductions on Form 1040, Schedule A.

FAQs

What records do I need to keep for tax deductions?

Maintaining thorough records—including receipts for all deductible expenses, detailed mileage logs for vehicle-related deductions, and bank and credit card statements to corroborate purchases—is essential. Also, ensure you keep all your tax forms, such as 1099s and W-2s, and any relevant emails or correspondence that can support the deductions you take. These records should be kept for at least three years from the date of filing your tax return to comply with IRS requirements and to facilitate any potential audits.

What is the difference between standard deductions and itemized deductions?

The difference between standard and itemized deductions is primarily in the method used to reduce taxable income. The standard deduction is a fixed amount determined by the IRS based on filing status and is adjusted annually for inflation. In contrast, itemized deductions require listing individual deductible expenses—such as mortgage interest, state and local taxes, charitable contributions, and medical expenses—that exceed a certain threshold. Taxpayers usually choose the method that lowers their taxable income the most.

How long do I need to keep my tax records?

The IRS advises keeping tax records for three years from the date you filed your return or two years from the date the tax was paid, whichever is later. However, if you underreported your income by more than 25%, keep your records for six years. For claims related to bad debt reductions or worthless securities, maintain records for seven years. In cases where no return was filed, indefinitely keeping records is recommended.

Bringing It All Together

After completing your first tax return, the process generally becomes more manageable each year. Many new real estate agents initially overlook crucial real estate agent tax deductions, often leading to unexpectedly high tax bills. Agents can significantly reduce their tax liability by staying proactive about these deductions and maintaining meticulous records.

Feel free to enlist the help of a good tax accountant to help you stay on track. You will need to keep good records and have a basic understanding of tax requirements from the start. By taking time throughout the year to look at your expenses and realtor tax deductions, you can safeguard against future financial surprises.

Add comment