Gross commission income (GCI) is the full amount of money a real estate agent may receive in exchange for representing a buyer, seller, or both in a real estate transaction. GCI is generally calculated by multiplying the commission rate by the final sale price.

But there’s much more to understanding this key calculation and why it matters to every real estate agent. We’ll explain the difference between GCI and the more complicated net commission income (NCI). We’ll give you a calculator, examples, easy-to-use formulas, and a few tips on how to increase your GCI in 2024.

What Is Gross Commission Income?

As we mentioned, GCI is the total commission paid as a result of a real estate transaction and is calculated by multiplying the commission rate by the final sale price of the property.

For example, if the commission rate for a particular listing is 6% and the final sale price is $250,000, the GCI would be:

$250,000 x .06 = $15,000

Basic Gross Commission Income Calculator

Want to calculate your own basic GCI? Fill in your final sale price and commission rate below.

When & Why GCI Can Get Complicated

The basic GCI calculation is pretty simple, but several situations can impact this otherwise straightforward formula, including your split, seller concessions, and more.

For example, let’s say the total commission paid on your new listing is 6%, but another agent brings the buyer. In this situation, that 6% commission is divided between two parties. The gross commission income for each agent is now 3%, calculated by dividing the original 6% in half (assuming an equitable split between both sides).

Price negotiations can also affect your GCI. Say you’ve got a seller concession of 2% of the sale price to cover the cost of some repairs. Depending on how the repair addendum is written, the 2% concession may or may not be included in the commissioned sale price.

When figuring your GCI, anything that affects the final amount upon which the commission is calculated must be taken into account.

However, it does get more complicated, especially when trying to figure out your actual take-home income, or your net commission income (NCI). Establishing your NCI requires additional calculations.

GCI vs NCI: What’s the Difference?

Your NCI is the dollar amount that’s left over from your GCI after everyone else gets their piece of the real estate commission. Though every agent and every transaction is unique, let’s look at some of the typical expenses deducted from the GCI to calculate your final NCI.

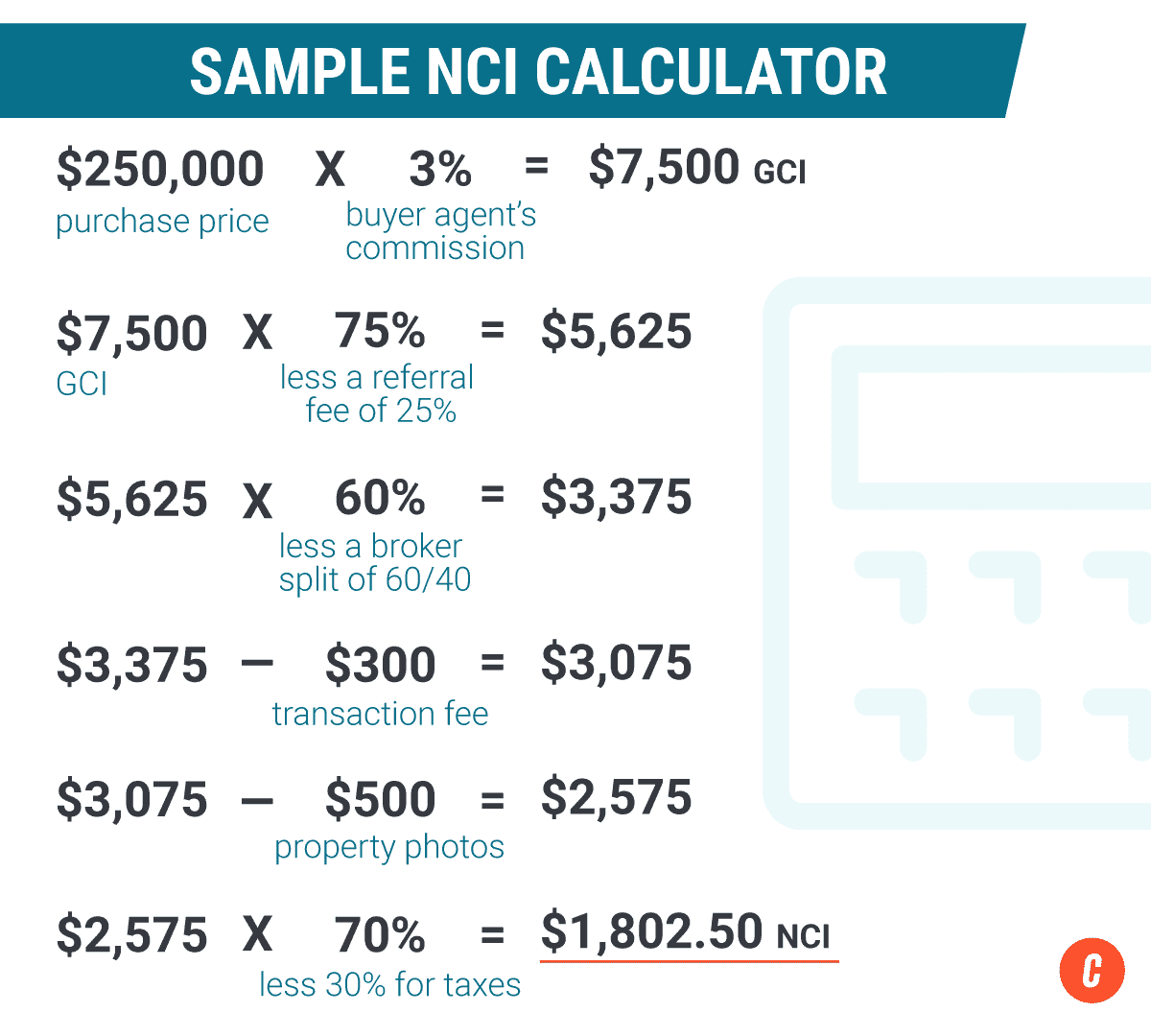

Sample Net Commission Income Calculation

When figuring out your NCI, a sample calculation may look like this:

Why GCI Matters for Real Estate Agents

If you’re a real estate agent working with a traditional cap and split agreement, knowing your GCI is essential for business planning. Imagine how much easier it is to plan out your expenses if you have a sense of what you’re projected to earn and when. It can also be an excellent barometer of how successful your lead generation and marketing efforts have been, and whether they are worth their costs. Your GCI is, above all, a tool for you to use to strategically build and budget for your business.

Cap Tracking

When most real estate agents sign on with a brokerage, they negotiate both their cap and their split with their broker. As a quick reminder, their split is the percentage from each commission they earn that goes to their broker. Their cap is the total amount of money an agent will pay via commission to their brokerage in a given year. A typical cap for a mid-sized, non-metro brokerage is between $20,000 and $30,000.

In the example above, we used a typical home sale price of $300,000 and a typical commission rate of 3%. Assuming there’s no referral fee to be paid, a gross commission ($9,000) would be split between the broker (40% – $3,600) and the agent (60% – $5,400).

This split would occur with each transaction until the agent hits their cap of $25,000. At this rate, it would take seven transactions for the agent to reach their annual cap.

Keeping track of your gross commission income throughout the year allows you to understand how close you are to meeting your cap requirements. In most brokerages, once you “hit cap,” you no longer have to split your commission with your broker, putting significantly more money in your pocket at the successful close of each transaction.

Strategic Planning

This shift impacts how you’ll plan your expenditures throughout the year. Knowing your cap helps you be more strategic in your marketing and budgeting. You should evaluate your business plan to make sure you’re taking advantage of your expected cap date. You can use this information to better craft your real estate business plan and set up better spending strategies for lead gen companies like Zillow Premier Agent. You can even adjust your real estate farming strategy based on how much additional revenue you’ll have available.

Measure Your Success

In the real estate industry, an agent’s success is often measured by their GCI. When you hear someone referred to as a “million-dollar agent,” they’re not talking about the price point of the homes they sell. They’re referring to that agent’s typical annual GCI.

Using GCI as a measuring stick makes it easier to compare an agent’s actual success rate. It’s certainly not the only way we should judge an agent’s success, but it’s a universally identifiable metric, so it’s important to know.

Qualify for Designations

Finally, you’ll need to reach a specific volume of transactions and GCI to qualify for certain real estate designations, like the CCIM designation. Keeping track of your GCI and the perks of reaching specific benchmarks is a great way to advance your real estate career.

How to Increase Your GCI

One of the easiest ways you can increase your GCI is to negotiate a better cap or split with your brokerage, or consider a low-cost virtual brokerage like eXp or REAL. Small adjustments in either your split and/or cap can make a big impact on your bottom line. If you have questions about choosing a brokerage, make sure to check out our Best Real Estate Companies to Work For article.

You can also follow us for more tips on lead generation, prospecting, lead nurturing, and marketing.

Bringing It All Together

Do you track your GCI closely? What do you do with that information? Tell us in the comment section below.

Add comment