Get ready to explore the sizzling real estate scene in the US! With some states amid a housing boom while others are grappling with challenges, it’s crucial to know which areas are thriving and which are struggling. I analyzed homes for sale, mortgage rates, local median home prices, new construction, and median household income to determine the top five states with the best housing market and the bottom five that could be doing better. Are you eagerly waiting to see if your state will be on the list? It’s time to find out!

Top 5 States with the Best Housing Market

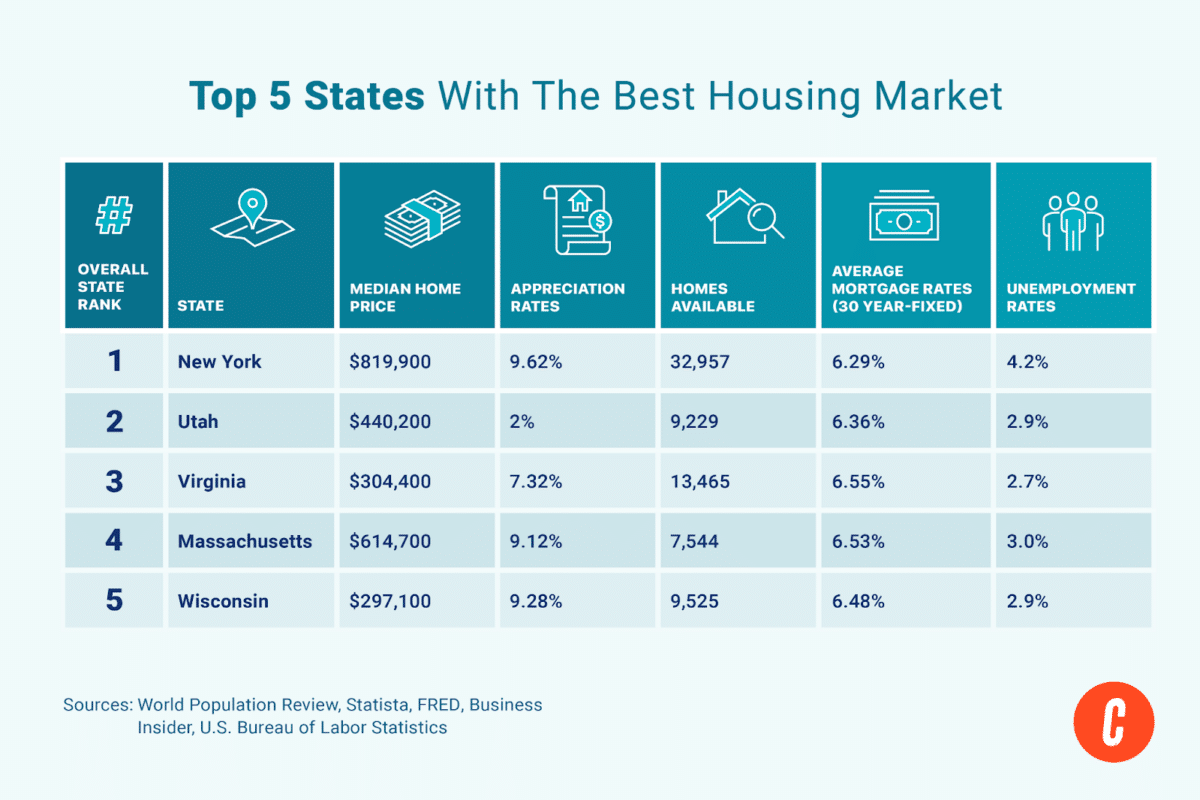

Want to know which state has the best housing market? These top five states with the best housing markets in the US have seen an increase, or rank higher, in median home prices, number of homes available, new construction, and median household income. The states with the best housing markets have also suffered less from the increasing mortgage rates and current housing market than other states. Keep reading to find out if your state made it to the top five!

1. New York

- Property Value Ranking: 10th

- Inventory Ranking: 6th

- Affordability Ranking: 24th

- Economy Health Ranking: 11th

New York is “the city that never sleeps,” and it’s no wonder, given that it has the best housing market in the US. As of May 2024, a whopping 32,957 existing homes were up for grabs, securing its position as the 4th highest in availability across the US. Amidst the low inventory market, the city still boasts a significant number of available homes. Moreover, the state saw an impressive 4,076 new constructions, ranking it 9th highest in the country.

With a median household income of $74,314 and a median home price of $819,900 (1st), the state offers a mix of affordability and opportunity. The impressive 9.62% appreciation rate and the lowest current mortgage interest rate at 6.29% make it an attractive prospect for prospective homeowners. Moreover, New York boasts a commendable ranking in terms of crime rate, landing the 10th lowest spot, and excels in community well-being with the 5th highest index score. No wonder New York’s real estate scene is creating a buzz!

Are you considering pursuing a real estate agent career in New York? Remember that New York does not have reciprocity agreements with any other state. However, if you’ve completed qualifying education outside of the state, you can apply for a waiver for the required course(s) for the state license. For more detailed information, look at our guide, Real Estate License Reciprocity & Portability: A State-by-State Guide.

2. Utah

- Property Value Ranking: 24th

- Inventory Ranking: 19th

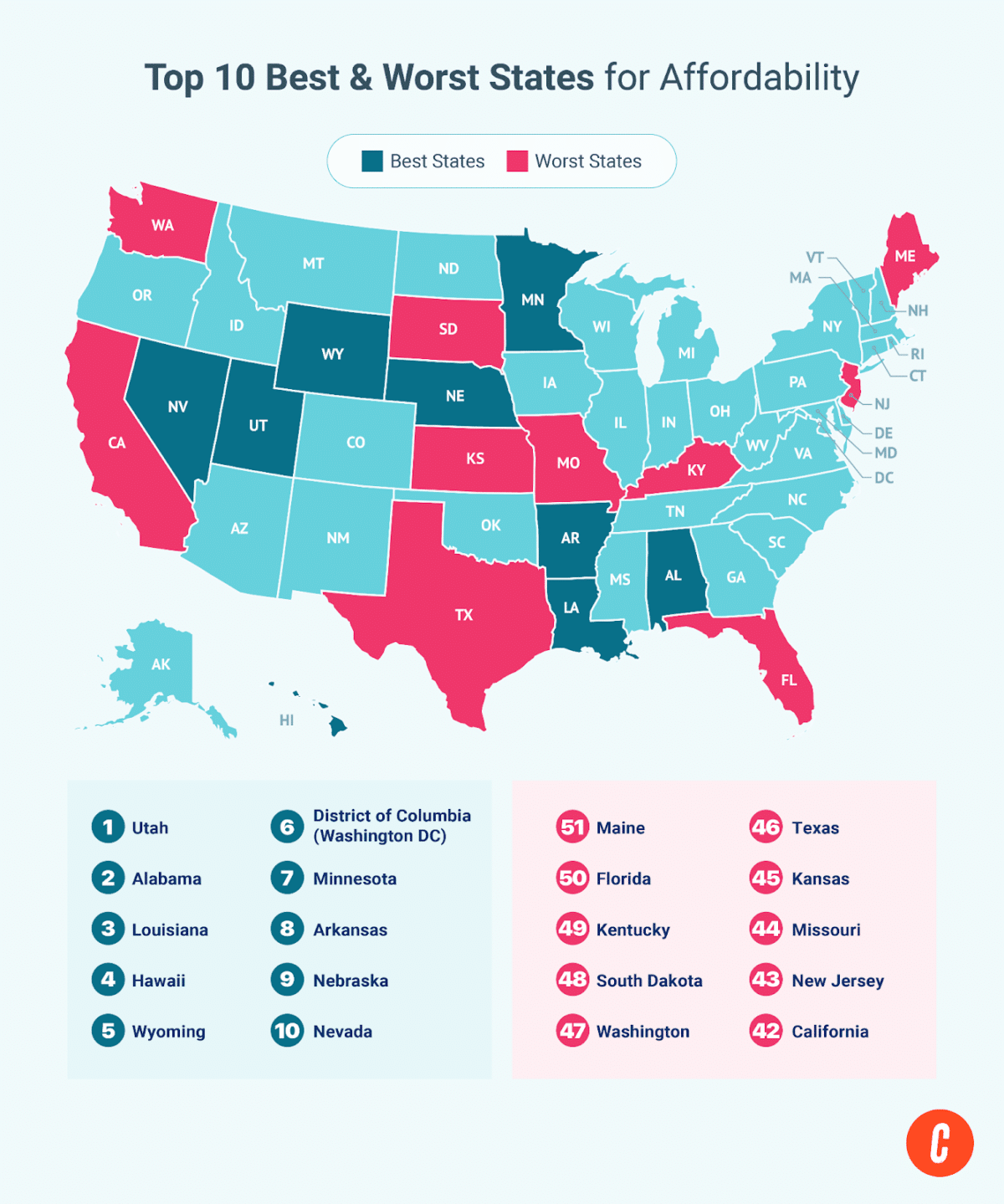

- Affordability Ranking: 1st

- Economy Health Ranking: 17th

The Beehive State has been ranked second among all states with the best housing markets. It’s also recognized as the most affordable state for housing, which should make you feel financially secure and comfortable. With an average mortgage rate of 6.36% (8th lowest), a tax burden of 0.58% (8th lowest), a relatively low cost of living index (29th lowest), and a median household income of $79,449 (12th highest), the Beehive State is indeed a great place to call home.

Utah’s economy is thriving, ranking 17th overall. It scored 10th highest for community well-being and boasts the 11th lowest unemployment rate at just 2.9%. Not to mention, there’s a healthy housing market with 9,229 homes available and 2,309 new ones constructed. Moreover, Utah has a high median home price of $440,200 (15th highest) and a low number of foreclosure filings at 576 (18th lowest). These statistics highlight the stability and growth of Utah’s housing market, making it one of the states with the best housing market in 2024.

3. Virginia

- Property Value Ranking: 33rd

- Inventory Ranking: 15th

- Affordability Ranking: 15th

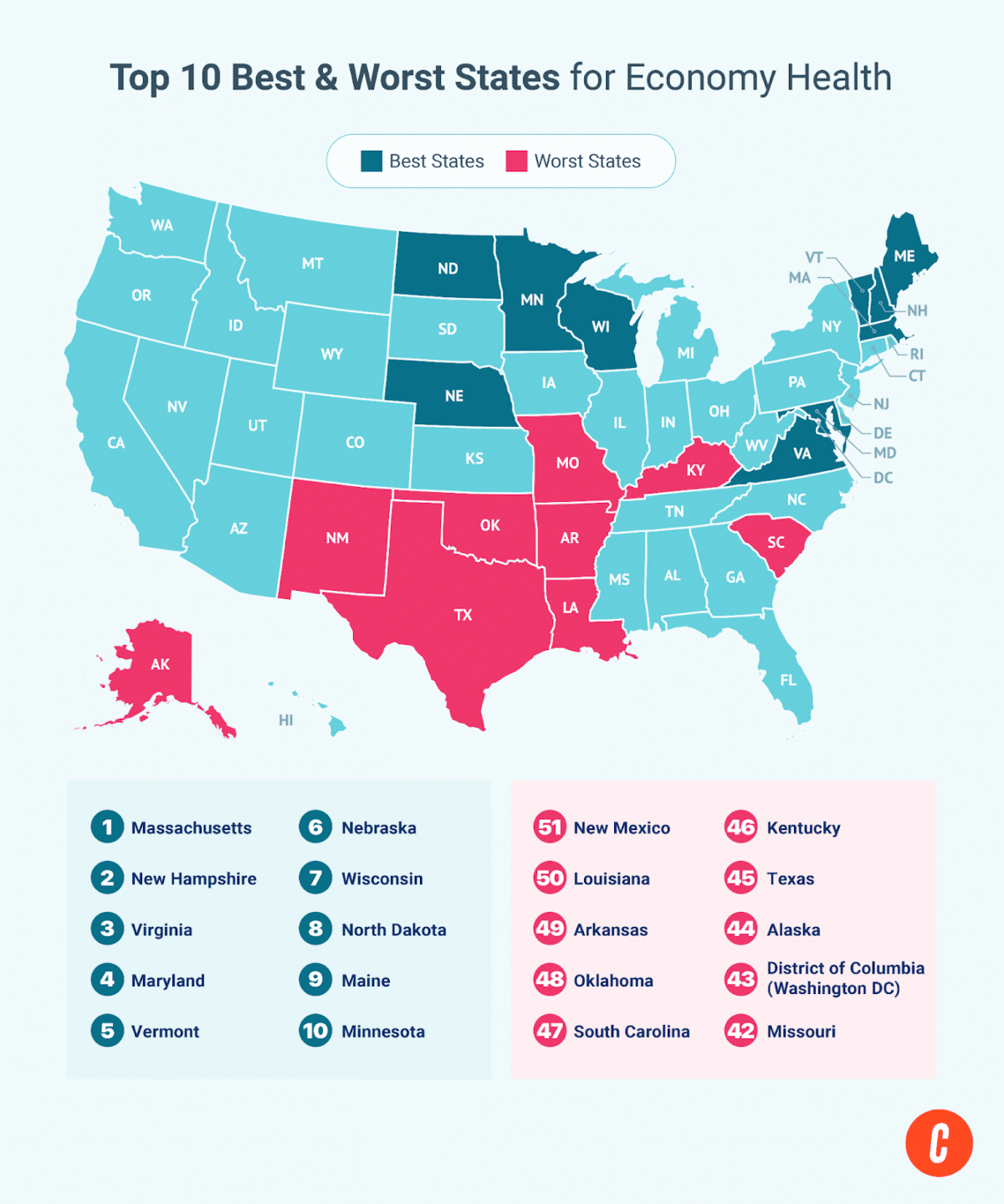

- Economy Health Ranking: 3rd

Virginia is one of the states with the best housing markets in 2024, coming in third among all states. This “Mother of Presidents” state also ranked third in the healthiest economy overall. Its unemployment rate is 2.7%, the 6th lowest, ensuring you can find employment if you move to Virginia. Moreover, the state has a high community well-being index score, ranking 11th highest and maintaining a low crime rate (8th lowest). These positive indicators make Virginia attractive to people seeking a stable and prosperous living environment.

Moreover, with an existing home inventory of 13,465 (18th-highest) and 2,386 new constructions, where Virginia has more new construction than any other state, ranking 15th-highest, so buyers looking for a brand-new home or planning to move will find a growth in available housing. The median household income is $80,963 (11th-highest), and the median home price is $304,400. The average mortgage interest rate dropped from 7.31% in 2023 to 6.55% in 2024, indicating an optimistic view for real estate agents and investors.

4. Massachusetts

- Property Value Ranking: 4th

- Inventory Ranking: 33rd

- Affordability Ranking: 29th

- Economy Health Ranking: 1st

Massachusetts, securing the fourth spot, has emerged as one of the states with the best housing market in the US this year. This Bay State ranked 1st in community well-being index score, 2nd lowest in crime rates, and 18th lowest in unemployment rate at 3%. This data ensures that people interested in moving to Massachusetts will indeed have an excellent living environment, with a strong job market providing financial security.

Furthermore, this state ranked 4th overall for property value ranking, indicating a high median home price at $614,700 (6th highest), a high appreciation rate at 9.12% (13th highest), and a reassuringly low number of foreclosure filings at 1,314 (33rd lowest). This state’s stability and potential for growth make it an ideal choice for home investors. People in this state have the 3rd highest median household income ($89,645), confirming they can buy a house confidently at current rates and terms.

5. Wisconsin

- Property Value Ranking: 17th

- Inventory Ranking: 21st

- Affordability Ranking: 26th

- Economy Health Ranking: 7th

Wisconsin, also called the Badger State, was ranked as the fifth-best real estate market in the US in 2024. This is because of its strong economy, ranking 7th overall. The state also has a low unemployment rate of 2.9%, the 12th lowest in the country. Additionally, Wisconsin has relatively low crime rates, ranking 12th lowest, and a relatively high community well-being score, ranking 25th highest. These factors show that Wisconsin is suitable for real estate investment and has the potential for market growth.

The state’s high appreciation rate of 9.28% makes it an attractive place for real estate investment. However, potential investors should be cautious, considering its ranking of 34th for median home prices ($297,100) and 25th for foreclosure filings. The state also has a reasonably low inventory, ranking 21st overall, and a high property tax burden of 1.85% (46th lowest), which should be factored into investment decisions.

Top 5 States With the Worst Housing Market

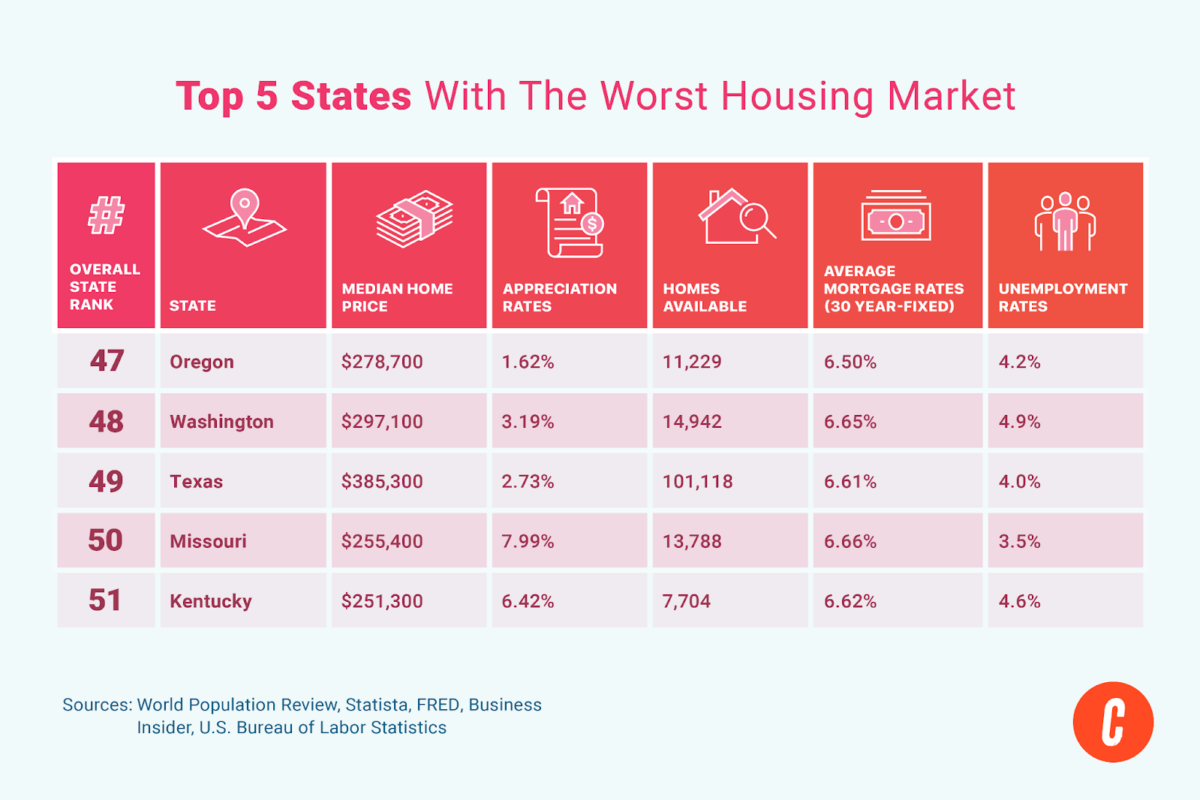

Shifting from the best states to buy real estate, the five worst housing markets in the US suffer from a low number of available homes and new construction as mortgage rates rapidly increase. The impact of low household incomes, which are significantly lower compared to other housing markets in the country, is a major factor that makes it difficult for potential homebuyers to afford homes, even with lower home prices. Read on to see if your state is among the worst to buy a house in.

1. Kentucky

- Property Value Ranking: 37th

- Inventory Ranking: 28th

- Affordability Ranking: 49th

- Economy Health Ranking: 46th

Kentucky has been identified as the worst housing market in the US. This is due to its extremely low median home prices, which rank 49th highest in the nation, and a low median household income, which is the 45th highest. Further, Kentucky faces the challenge of extremely high average mortgage rates, standing at 6.62%. The state is also battling a high unemployment rate of 4.6% and a meager community well-being index score, ranking 46th highest in the country.

The state also faces challenges in boosting its low housing inventory, with only 7,704 available homes (ranking 30th) and 1,602 new construction properties (ranking 23rd). For real estate investors, it’s crucial to exercise caution when considering investments in this state due to its relatively low appreciation rate of 6.42% compared to other states. This caution will ensure you are well-informed and prepared for potential risks.

2. Missouri

- Property Value Ranking: 36th

- Inventory Ranking: 24th

- Affordability Ranking: 44th

- Economy Health Ranking: 42nd

Missouri, known as the Show-Me state, has a challenging real estate market. It ranks second among the worst housing markets in the US. This ranking is driven by high average mortgage rates (49th lowest) and low median household income (41st highest), making it tough for people to purchase homes in the state.

In addition, Missouri is facing economic challenges, with a high unemployment rate of 3.5%, higher crime rates (ranked 41st lowest), and a low community well-being index score (34th highest), which could discourage potential residents from relocating to the state.

3. Texas

- Property Value Ranking: 50th

- Inventory Ranking: 2nd

- Affordability Ranking: 46th

- Economy Health Ranking: 45th

Despite being at the top for new construction and having the second-highest number of homes available, Texas surprisingly has the third-weakest housing market in 2024. This ranking is due to its low property value, with rankings of 49th for foreclosure filings, 45th for appreciation rates, and 21st for median home prices. Besides that, the Lone Star State faces a hefty property tax burden of 1.8% and average mortgage rates of 6.61%. The state also grapples with high unemployment rates (4%), crime rates, and a low community well-being score.

4. Washington

- Property Value Ranking: 46th

- Inventory Ranking: 11th

- Affordability Ranking: 47th

- Economy Health Ranking: 39th

Amid the high volume of homes available on the market (15th highest), new construction (11th highest), and median household income (8th highest) in the US., Washington suffers from the high cost of living (43rd lowest) and average mortgage rates (48th lowest). These rankings provide a comprehensive view of the housing market conditions in Washington.

In addition, the Evergreen State suffers from relatively low median home prices ($297,100), low appreciation rates (3.19%), quite a high property tax burden (0.94%), very high unemployment rates (48th lowest), and high crime rates (44th lowest), making it one of the worst housing markets in the US.

5. Oregon

- Property Value Ranking: 49th

- Inventory Ranking: 27th

- Affordability Ranking: 27th

- Economy Health Ranking: 37th

Oregon’s housing market presents various challenges. Compared to other states, Oregon has relatively low median home prices, ranking 38th highest, and appreciation rates, ranking 48th highest. Additionally, the high number of foreclosure filings contributes to the market’s weakness, ranking 21st lowest. On a positive note, the state performs well in community well-being, ranking 14th highest. However, Oregon struggles with high unemployment, standing at 4.2% (39th lowest) and crime rates, ranking 42nd lowest.

Full Data & Methodology for States with the Best Housing Markets

| STATE RANKING FINAL | State | Property Value Ranking | Inventory Ranking | Affordability Ranking | Economy Health Ranking |

|---|---|---|---|---|---|

| 1 | New York | 10 | 6 | 24 | 11 |

| 2 | Utah | 24 | 19 | 1 | 17 |

| 3 | Virginia | 33 | 15 | 15 | 3 |

| 4 | Massachusetts | 4 | 33 | 29 | 1 |

| 5 | Wisconsin | 17 | 21 | 26 | 7 |

| 6 | Hawaii | 14 | 41 | 4 | 13 |

| 7 | Georgia | 30 | 5 | 13 | 25 |

| 8 | Tennessee | 18 | 8 | 12 | 40 |

| 9 | New Jersey | 12 | 12 | 43 | 12 |

| 10 | Nebraska | 28 | 37 | 9 | 6 |

| 11 | New Hampshire | 3 | 46 | 30 | 2 |

| 12 | Colorado | 25 | 10 | 16 | 31 |

| 13 | Minnesota | 41 | 25 | 7 | 10 |

| 14 | Connecticut | 7 | 38 | 20 | 18 |

| 15 | Pennsylvania | 22 | 13 | 38 | 15 |

| 16 | Vermont | 1 | 48 | 35 | 5 |

| 17 | Maryland | 29 | 23 | 36 | 4 |

| 18 | Alabama | 43 | 17 | 2 | 33 |

| 19 | Arizona | 23 | 7 | 34 | 32 |

| 20 | Wyoming | 31 | 49 | 5 | 14 |

| 21 | North Dakota | 34 | 47 | 11 | 8 |

| 22 | Idaho | 20 | 31 | 28 | 21 |

| 23 | Michigan | 42 | 16 | 18 | 27 |

| 24 | Mississippi | 16 | 35 | 23 | 29 |

| 25 | West Virginia | 5 | 44 | 17 | 38 |

| 26 | Maine | 8 | 39 | 51 | 9 |

| 27 | California | 32 | 3 | 42 | 30 |

| 28 | District of Columbia (Washington, D.C.) | 13 | 45 | 6 | 43 |

| 29 | South Carolina | 19 | 9 | 32 | 47 |

| 30 | Montana | 9 | 40 | 33 | 28 |

| 31 | Florida | 38 | 1 | 50 | 22 |

| 32 | South Dakota | 6 | 43 | 48 | 16 |

| 33 | Rhode Island | 2 | 51 | 41 | 19 |

| 34 | Nevada | 39 | 29 | 10 | 36 |

| 35 | Kansas | 15 | 34 | 45 | 23 |

| 36 | Delaware | 27 | 42 | 22 | 26 |

| 37 | North Carolina | 35 | 4 | 37 | 41 |

| 38 | Indiana | 45 | 18 | 21 | 34 |

| 39 | Illinois | 44 | 20 | 31 | 24 |

| 40 | Oklahoma | 21 | 26 | 25 | 48 |

| 41 | Alaska | 11 | 50 | 19 | 44 |

| 42 | Louisiana | 51 | 22 | 3 | 50 |

| 43 | Arkansas | 40 | 30 | 8 | 49 |

| 44 | New Mexico | 26 | 36 | 14 | 51 |

| 45 | Ohio | 47 | 14 | 39 | 35 |

| 46 | Iowa | 48 | 32 | 40 | 20 |

| 47 | Oregon | 49 | 27 | 27 | 37 |

| 48 | Washington | 46 | 11 | 47 | 39 |

| 49 | Texas | 50 | 2 | 46 | 45 |

| 50 | Missouri | 36 | 24 | 44 | 42 |

| 51 | Kentucky | 37 | 28 | 49 | 46 |

If you’d like to see all the information used to conduct our study, click here for all the data.

We analyzed several key components to determine the states with the strongest housing markets. These included median home prices, appreciation rates, existing inventory, new construction, household income levels, mortgage interest rates per state, and unemployment rates. These important real estate statistics provide valuable insights into the overall health of a housing market.

To determine the strongest and weakest housing markets in 2024, click the tabs below to dive into the individual data and sites:

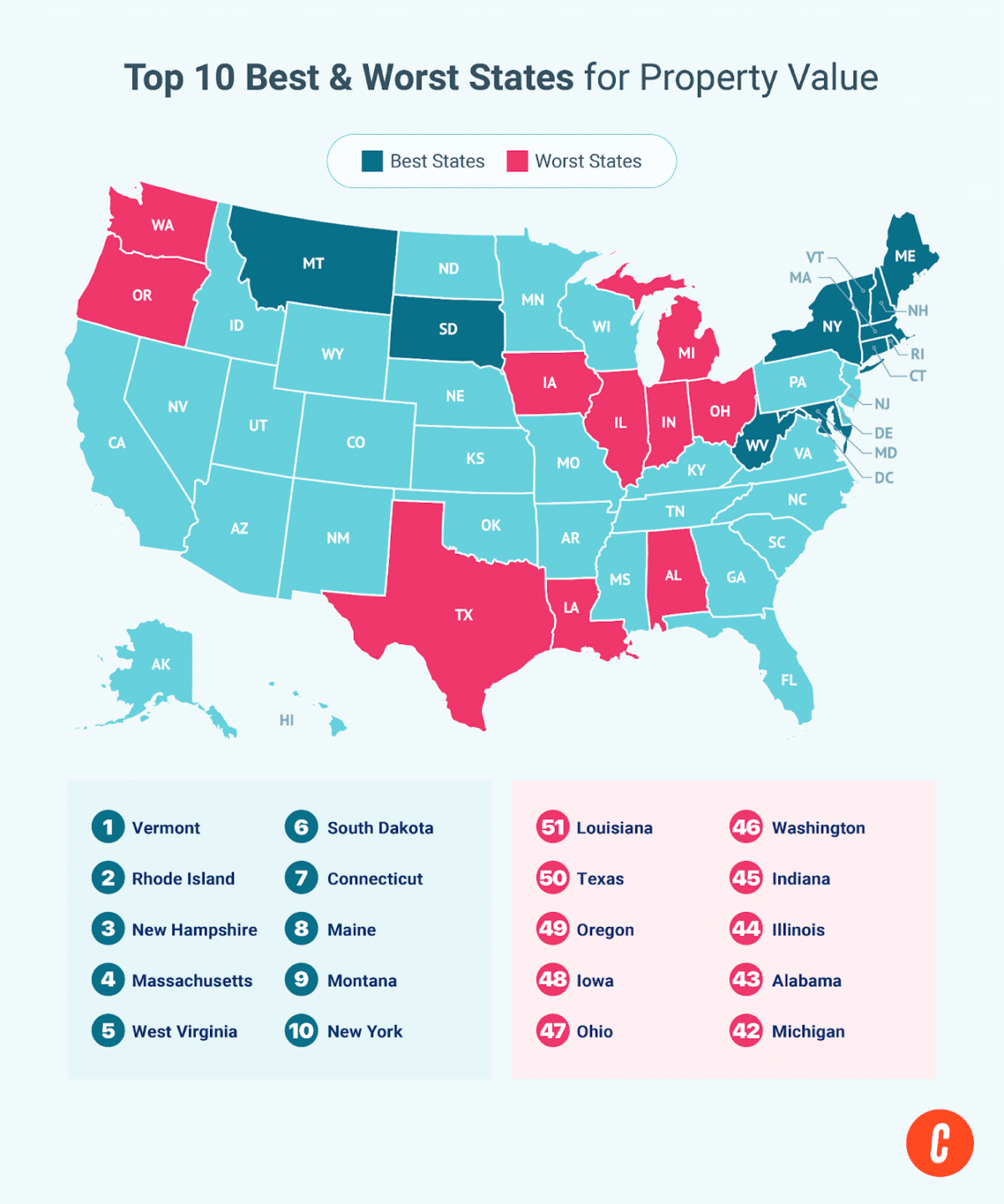

Property Value Ranking

In this data, we evaluated the following:

- Median home prices (from World Population Review)

- Appreciation rates (from Statista)

- Number of foreclosure filings (from World Population Review)

The price of housing is the most important indicator of the housing market’s health. This is because the price is the main factor buyers consider when searching for property. Higher home prices, increased appreciation rates, and lower foreclosure filings indicate a ‘hot’ market, showing homes are in high demand.

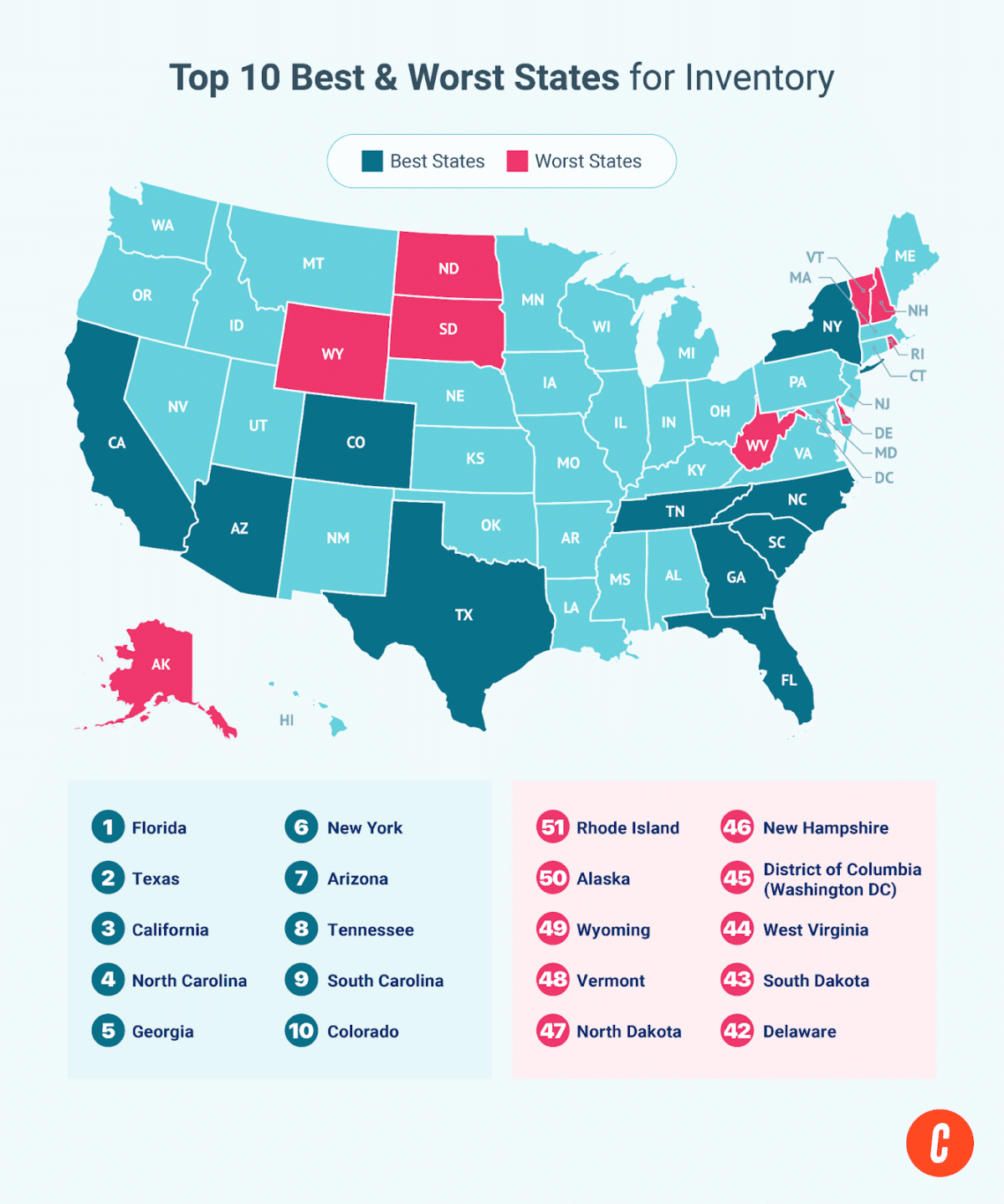

Inventory Ranking

In this data, we analyzed the following:

- Number of homes available as of May 2024 (from FRED)

- New construction, permits per state as of April 2024 (from BPS—Permits by State)

When fewer homes are available, buyers have fewer choices and tend to buy less. On the other hand, having more homes for sale creates a strong housing market, attracts buyers, and helps the overall financial health. Additionally, building new homes helps communities grow by offering more options for middle-income or first-time homebuyers, giving those with a limited budget more choices, and showing overall growth in the housing market.

Affordability Ranking

In this data, we looked at the following:

- Median household income (from World Population Review)

- Cost of living index (from World Population Review)

- Property tax burden (from District Lending)

- Average mortgage rates, 30-year-fixed as of May 2024 (from Business Insider)

Household income is vital for buying a home. Lower incomes make it less likely, while higher incomes make it easier. Higher incomes also indicate a stronger housing market. Low mortgage rates can show high demand for home loans and a “hot” market.

Economy Health Ranking

In this data, we assessed the following:

- Unemployment rates as of May 2024 (from US Bureau of Labor Statistics)

- Crime rates per 100,000 (from World Population Review)

- Community well-being index score, out of 100 (from Interactive Map—Sharecare)

When analyzing whether a state has a robust real estate market, it’s important to consider the overall economic well-being. This consideration includes examining unemployment, crime, and community well-being index scores. These indicators provide valuable insight into the health and stability of the local economy, which is a key determinant of the strength of the real estate market.

Frequently Asked Questions (FAQs)

What state has the most reasonable housing prices?

According to the World Population Review, Iowa has the lowest median home price at $230,600, followed by North Dakota with a median home price of $240,900 and Kentucky with a median home price of $251,300.

What state has the hottest real estate market right now?

The top ten hottest states for real estate right now, based on our analysis, are the following:

- New York

- Utah

- Virginia

- Massachusetts

- Wisconsin

- Hawaii

- Georgia

- Tennessee

- New Jersey

- Nebraska

Bringing It All Together

New York was named the state with the best housing market. It offers affordable home prices, a good number of available homes, decent wages, and a growing population and job market. On the other hand, Kentucky has the worst housing market in the US, with low median home prices and median household income. The number of available homes and new construction is low, and the mortgage rates are pretty high.

Now that you have the inside scoop on the data for the best (and worst) states, comment below to let us know how the market is doing in your state!

Add comment