Are you tired of the monthly rent chase? Say goodbye to this stress with the convenience of online rent payment services! These services are designed to be user-friendly and allow you to track rent payments and automate rent collection easily. Check out this list of best online rent payment services for landlords, and never stress about rent collection again.

- Baselane: Best for the free subscription and accounting tools

- Hemlane: Best for an all-in-one solution and intuitive interface

- PayRent: Best for secured online rent collection

- TenantCloud: Best for mobile app

- Avail: Best for next-day rent payment feature

The Close’s Top Picks for Best Online Rent Payment Services

| Online Rent Payment Software | Best for | Starting Monthly Price | Learn More |

|---|---|---|---|

| Free subscription and accounting tools | Free | Visit Baselane | |

| All-in-one solution and intuitive interface | Free | Visit Hemlane |

| Secured rent collection | Free | Visit PayRent |

| Mobile app | $15.60 (billed annually) | Visit TenantCloud | |

| Next-day rent payment | $0 per unit | Visit Avail |

| Online Rent Payment Software | Best for | Starting Monthly Price | Learn More |

|---|---|---|---|

| Free subscription and accounting tools | Free | Visit Baselane | |

| All-in-one solution and intuitive interface | Free | Visit Hemlane |

| Secured rent collection | Free | Visit PayRent |

| Mobile app | $15.60 (billed annually) | Visit TenantCloud | |

| Next-day rent payment | $0 per unit | Visit Avail |

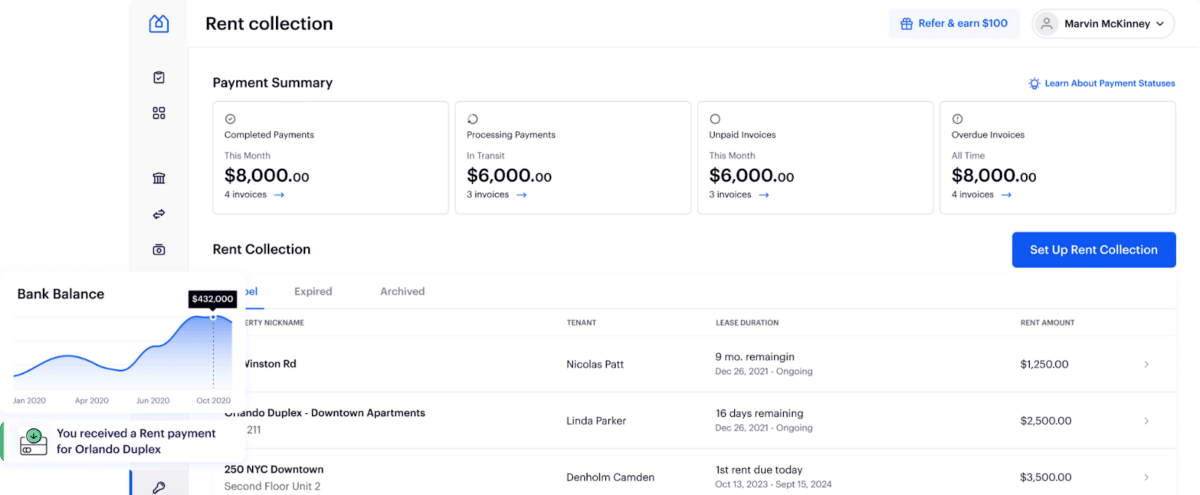

Baselane: Best for Free Subscription & Accounting Tools

Why I Chose Baselane

-

Baselane Pricing: Free for banking, online rent collection, and bookkeeping

Baselane ranked first as the best online rent payment service for its free subscription with no monthly fees or minimum balances. Not only does it send automated payment reminders to tenants, but it also deposits payments directly into your bank account within 2 to 5 days. I also love that tenants can pay rent on any device through ACH bank transfer or debit or credit card and easily enroll in auto-pay. On top of that, Baselane provides real-time cash flow, performance tracking, and auto-generated financial and tax reports.

Additional Features

- Baselane checkbooks: Order checkbooks directly for any Baselane checking account, eliminating the need for third-party providers. Each order includes 80 high-security checks.

- Create and e-sign lease agreements: Baselane and Rocket Lawyer team up so you can easily make, save, and sign lease agreements in Baselane. You can also invite others to sign.

- Send checks online: Securely pay vendors and bills from your Baselane checking account by sending checks directly. Just enter the payment amount, recipient’s name, and address, and Baselane will print and mail the check for you.

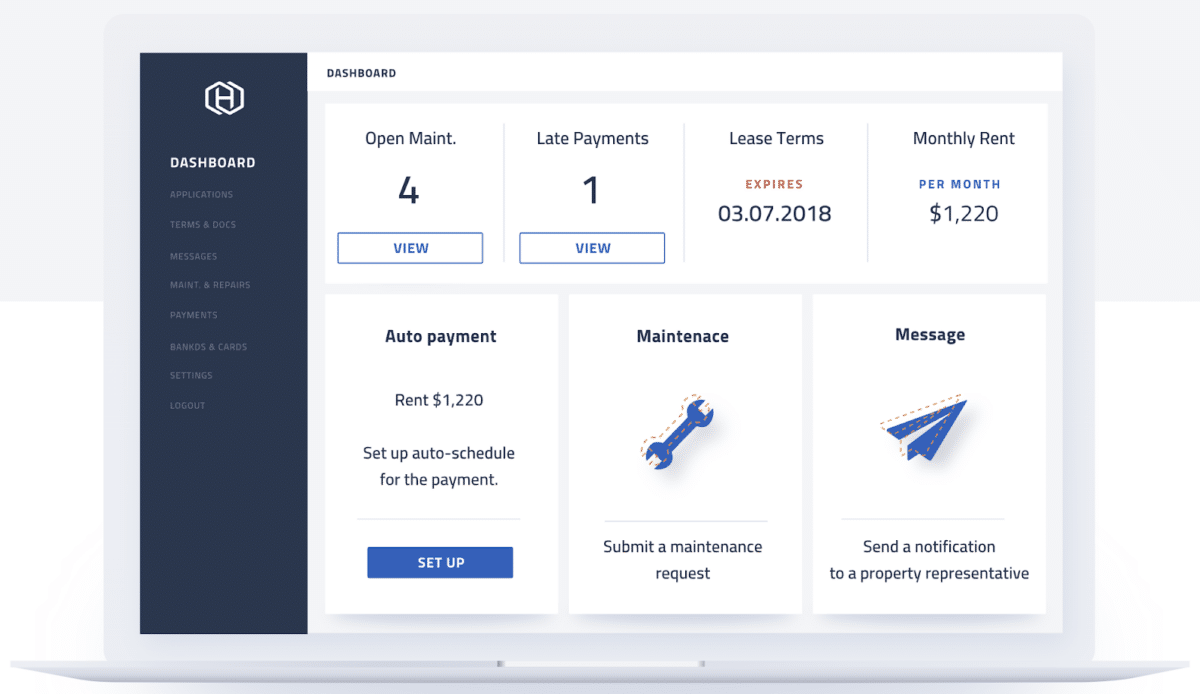

Hemlane: Best for All-in-One Solution & Intuitive Interface

Why I Chose Hemlane

-

Hemlane Monthly Pricing (based on annual billing, monthly billing available at higher rate):

- Free Forever

- Basic: $30

- Essential: $48

- Complete: $96

Hemlane provides a one-stop solution, including online rent collection service, maintenance coordination, tenant screening, and financial reporting. With its easy-to-use interface and flexible pricing, including a free plan, Hemlane is ideal for landlords prioritizing efficiency and peace of mind. What’s more, Hemlane enables online rent payments through ACH and credit cards, ensuring timely payments with automated reminders and late fees. Landlords receive payments directly deposited into their accounts without any deductions.

Additional Features

- Maintenance Coordination: The platform has a 24/7 service for managing maintenance requests. Hemlane’s team handles tenant repair requests, works with preferred service professionals, and ensures clear communication and timely solutions.

- Financial Reporting: It helps landlords track income and expenses and generate detailed financial reports. It also integrates with accounting software for seamless financial management.

- Marketing and Listing: Hemlane promotes rental properties on popular listing websites like Zillow, Trulia, Hotpads, and Zumper. This increases property visibility and helps attract potential tenants.

- Tenant Screening: Hemlane thoroughly screens potential tenants, including background checks, credit reports, and eviction history. This helps landlords choose reliable tenants.

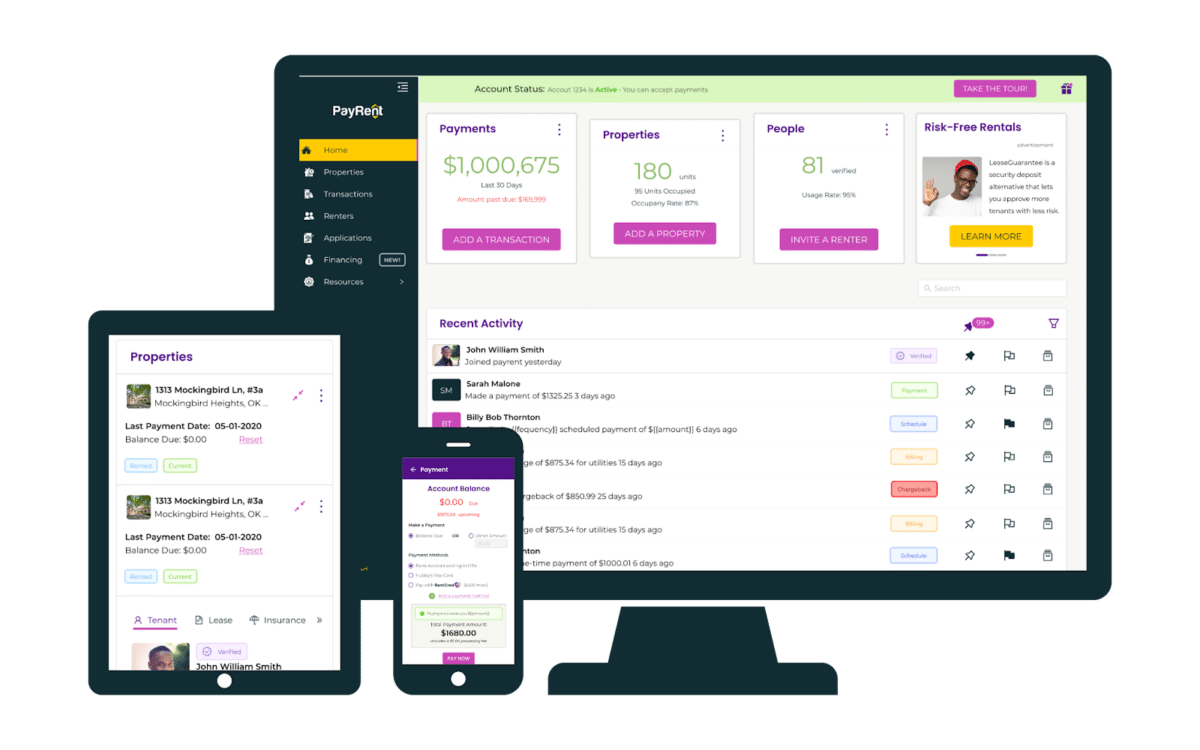

PayRent: Best for Secured Online Rent Collection

Why I Chose PayRent

-

PayRent Monthly Pricing:

- Pay-As-You-Go: $0

- Do-It-Yourself: $19 (try free for 7 days)

- Go-Like-A-Pro: $49 (try free for 14 days)

Keep your transactions secure with PayRent’s safe payment methods. Easily accept credit cards or bank transfers from any US-based bank or credit union without having to share your personal information with your tenants. With RentDefense™, effortlessly collect rent while enjoying exclusive payment controls and protections. Plus, the platform offers convenient features like recurring payment options and direct deposit into your bank account, ensuring that you receive timely and reliable rent payments.

Additional Features

- Account balance tracking: Renters can easily check their account status using PayRent’s online rent payment services. They can see how much they owe, upcoming charges, and payments. Landlords and renters can access these digital records to ensure agreement about the account status.

- Split payments: Tenants can divide their rent payments between multiple payment methods.

- Tenant applications and screening: Landlords can get critical information about potential renters and their backgrounds through one of our in-app application partners. This includes personal and household details, employment and income, residential history and background, credit score, criminal history, and evictions.

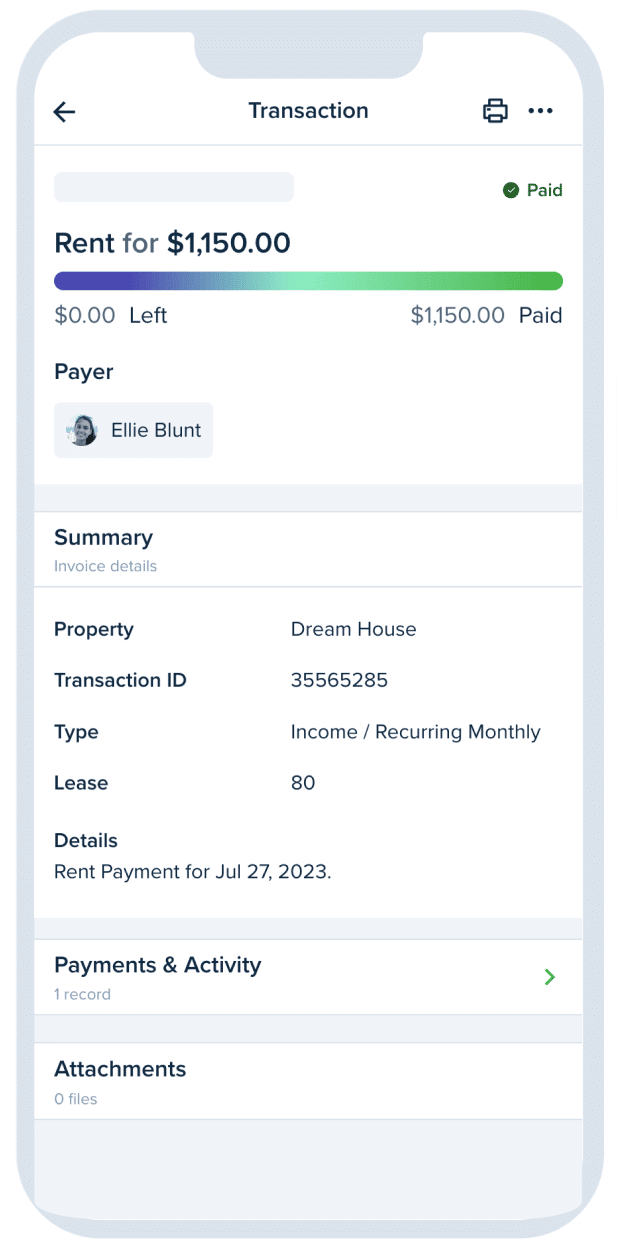

TenantCloud: Best for Mobile App

Why I Chose TenantCloud

-

TenantCloud Monthly Pricing (based on annual billing, monthly billing available at higher rate):

- Starter: $15.60

- Growth: $29.30

- Pro: $50.40

- Business: Contact for pricing

Check out the TenantCloud mobile app for iOS and Android—it’s completely free! With this app, efficiently manage your dashboard, team, rent collection, and tenant screenings without constantly logging in and out of your account. TenantCloud makes it easy for landlords and tenants to manage rent payments online. It offers direct bank transfers, ACH payments, credit/debit card options, and payment tracking. I also love that tenants can set up Auto Pay, and landlords can customize payment settings, late fees, and payment allowances.

Additional Features

- Rental accounting: Store, organize, find, and summarize financial information. You can easily track property transactions and balances, schedule invoices, late fees, and receipts, apply deposits, refunds, and discounts, and export all your account data to a ZIP file.

- Financial reports: Landlords can use Schedule E and other tax reports to manage their taxes. They can also generate and send 1099 tax forms to recipients digitally through their accounts. Additionally, they can synchronize income and expense transactions with QuickBooks for better task management.

- Rental applications: Tenant applicants can send their applications to your TenantCloud account. Then, you’ll review and approve the applications. Modify the application form to ask about basic things like living and work history, income, and references. You can also ask for an application fee and check their background and credit to make the process faster.

Avail: Best for Next-day Rent Payments

Why I Chose Avail

-

Avail Monthly Pricing:

- Unlimited: $0 per unit

- Unlimited Plus: $9 per unit

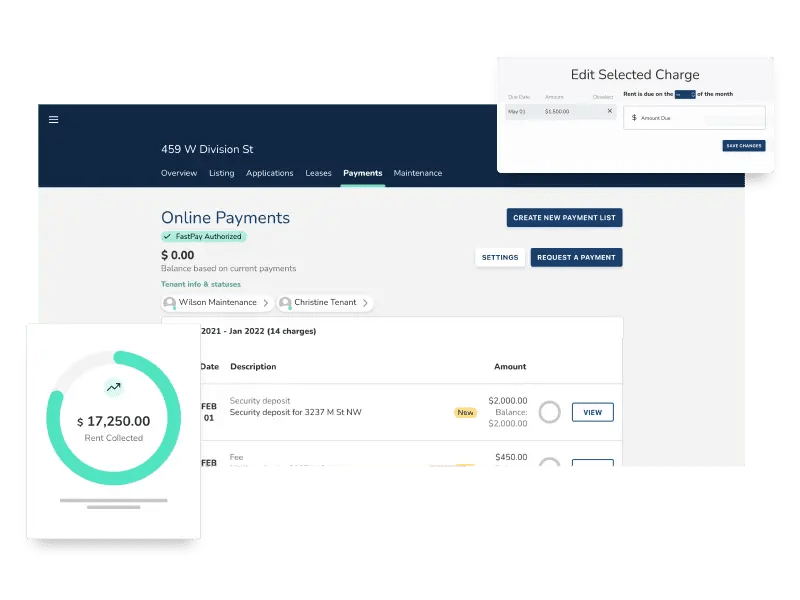

Experience the convenience of Avail FastPay, where landlords can receive funds as quickly as the next business day. With Avail’s online rent payment services, you’ll enjoy specialized deposit and fee collection, automatically generated payment receipts and confirmations, and seamless setup for recurring payments. Landlords can also set up rent reminders and notifications, auto-assess late fees (one-time or recurring), and allow rental payments to be reported to credit bureaus with CreditBoost.

Additional Features

- Property accounting: This feature allows landlords to track their finances accurately. Landlords can see how much money their rental properties make and their running costs. Avail’s system will automatically populate your dashboard with payments and maintenance expenses.

- Maintenance tracking: Avail’s maintenance tracking feature includes instant messaging for tenant communication in the app and automatic email notifications for landlords or contractors when maintenance requests are submitted. It also provides status updates on maintenance tickets and allows landlords to add expense details for better financial organization.

- Leasing agreements and online signatures: Avail offers state-specific lease agreement templates that comply with landlord-tenant laws. The system converts your preferences into a binding contract and allows for digital signatures from tenants. Other features include locally generated clauses, unlimited document attachments, and print and PDF lease generation.

Methodology: How I Chose the Best Online Rent Payment Services

I evaluated the best online rent payment services by using a weighted rubric created by our team of licensed real estate professionals, writers, and editors. Our team spent hours researching dozens of companies and assessing each based on the most impactful elements for landlords, tenants, and property managers. Here are the criteria we used for our evaluations.

- Pricing (25%)

- I looked at the average price per unit or month for subscription plans and if the software offers a free trial.

- General Features (10%)

- I evaluated each company’s main features, like rental listing management, rental applications, applicant screening, generating leases, maintenance requests, and tenant portal.

- Advanced Features (30%)

- I assessed whether the platforms offer direct deposit, autopay, free ACH, collection of security deposits and pet fees, and accept payments via debit/credit card or bank account. I also evaluated if each software features automated payment reminders, automated late fees, and the ability to accept partial payments. Additionally, I checked if each platform has payments available the next business day, payment tracking and reporting, and personal vs. business expense tracking.

- Ease of Use (10%)

- It is based on how easy it is to navigate the provider interface and whether it provides hassle-free transactions and communication between property owners and tenants. It also considers if the platform offers a mobile app, third-party integrations, and an automated system.

- Help & Support (10%)

- We looked into the convenience and attainability of customer service for technical and customer support.

- Customer Rating (10%)

- I read software reviews after taking it for a test drive to evaluate others’ experiences compared to my own. I take that additional feedback into account when assessing any software.

- Expert Score (10%)

- I give extra credit for any standout features not covered in the above categories.

Your Take

Online rent payment services offer landlords the tools for seamless rent collection. With secure online payments, automatic reminders, and detailed reporting, landlords can improve their rental management experience. It’s time to take the hassle out of rent collection and elevate your landlord game.

Share your thoughts in the comments section—let’s make rent collection a breeze!

Add comment