Fractional ownership is a creative way for investors to get into the market. Imagine owning a sliver of a plush vacation or a commercial property without taking on the whole cost of ownership. This investment opportunity essentially democratizes property investment for the mass investor through affordability and manageability. I will cover what fractional ownership is, its advantages versus disadvantages, and how it stacks up against more traditional timeshares.

What is Fractional Ownership in Real Estate?

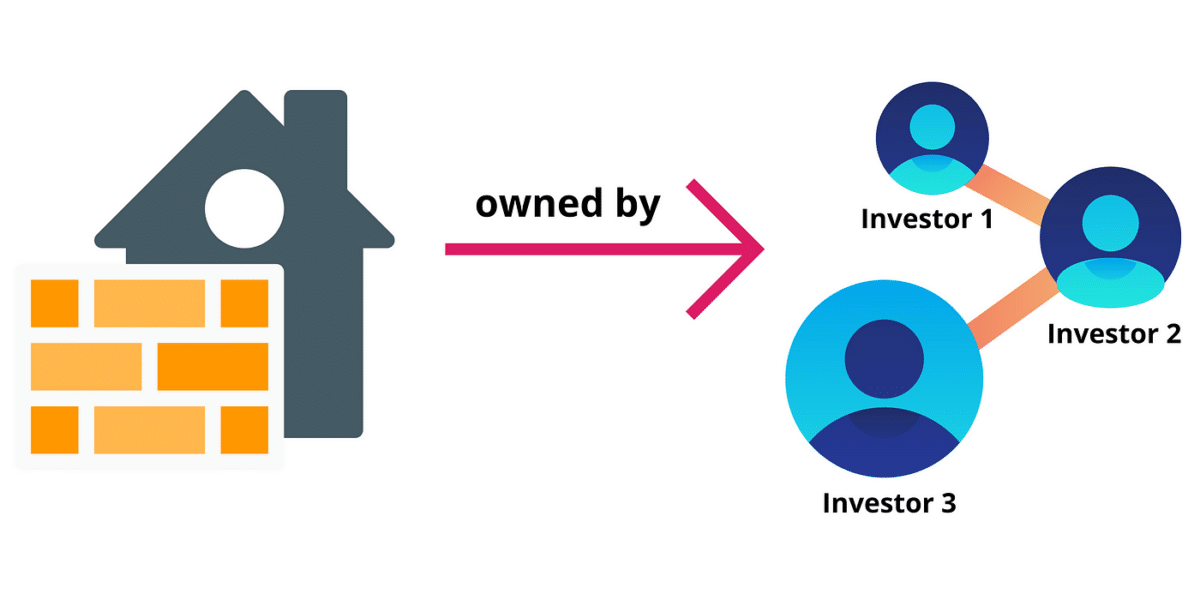

Fractional ownership in real estate is a concept where property ownership is divided among several investors. Instead of buying an entire property, investors buy fractions of that property, which are usually between 1/8 and 1/2. The notion of shared ownership allows a single investor to afford high-value real estate without the large financial upfront costs normally required for owning an entire property.

Basically, it’s sharing expenses and benefits that come with owning a property. Each investor owns a share of the property directly proportional to each invested amount. Ownership interest does not confine itself only to shares in the property but extends to its usage rights, rental income received, and appreciation. The structure of fractional home ownership is different, but most of it includes a formal agreement spelling out the rights of each owner, duties, and terms of usage.

Key Elements of Fractional Ownership

Fractional ownership real estate allows someone to invest in prime properties and diversify a real estate portfolio without committing the full finances toward purchasing an independent property. This formula combines personal use with an excellent potential for income generation, hence an investment alternative attractive to your lifestyle and investment purposes. Here are some key elements of fractional ownership homes:

- Ownership share: An investor gets a certain specified percentage of the property on top of a share of equity, usage rights, and income.

- Usage rights: Generally, owners have the right to use the property for a certain number of days or weeks per year. Again, this would depend upon the fraction of ownership interest and terms specified in the contract.

- Income and expenses: The owners share any income from the property, including any rental income, based on their proportional interest in the property. Likewise, expenses such as maintenance, property tax, or management fees are shared proportionately.

- Management and maintenance: The property is usually managed by a professional management company, which takes care of everyday operations, maintenance, and other administrative tasks, relieving owners of those responsibilities.

- Exit strategy: An owner may sell their share in the property after an agreed-upon holding period. In some fractional home ownership schemes, there is a secondary market through which shares can be traded, and the investors achieve liquidity.

Pros & Cons of Fractional Ownership

Fractional ownership has its own set of advantages and disadvantages. Understanding these can help investors understand if this investment model supports their investment goals and preferences. Here are the key pros and cons of fractional ownership:

Types of Fractional Ownership Models

Fractional ownership comes in many forms, all of which are targeted at different investor preferences and goals. Knowing about these models will help investors invest in the best form that suits their needs. Whether you’re looking for personal use, investment returns, or a mix of both, a fractional ownership model covers each of these preferences. Here’s how to break down the primary types of fractional ownership examples:

Equity Shares

The investors have a percentage of equity share in the property. Emphasis is placed on investment returns through property appreciation and rental income. A deeded interest in the property is included with the ownership. In this model, the investors have an opportunity to share both the usage time of the property and its financial performance. This can be clearly noted in luxury vacation homes wherein the investors can personally use the property while reaping its financial benefits.

Use-based Shares

This fractional ownership is based on the right to use the property for certain days or weeks per year, emphasizing personal usage other than financial returns. Ownership is often paired with a contractually agreed-upon right of usage and direct ownership. This is often used with vacation properties where owners can take regular vacations.

Syndicated Shares

In syndicated shares, investors pool their resources to acquire larger properties, typically managed by a professional syndicator. This model combines usage and financial return and focuses on larger-scale investments. Investors own a share of the syndicate, which holds the title to the property.

Common examples include commercial real estate or multifamily apartment complexes managed by a syndication company. This model enables an investor to acquire a share of high-value property with professional management and share in usage and financial benefits.

How Fractional Ownership Compares with Traditional Real Estate Investments

Fractional ownership, like any other form of traditional real estate investing, has differences that make it more or less appropriate for specific investors. We’ll break down how fractional ownership differs from the traditional model below:

| Aspect | Fractional Ownership | Traditional Real Estate Investment |

| Control | Less control over property management and decisions that are shared among multiple investors. | Complete control over property management and decisions. |

| Capital Requirement | Lower initial investment by sharing costs with other investors. | Requires high capital to purchase the entire property. |

| Management | Professionally managed reducing personal involvement. | Requires extensive time and effort for property management and maintenance. |

| Financial Returns | Potential for rental income and property appreciation, but income is shared among investors. | Potential for substantial rental income and property appreciation, benefiting the sole owner. |

| Portfolio Diversification | Easier to diversify by investing in multiple properties through fractional ownership. | Diversification requires significant capital and management resources. |

| Liquidity | May face challenges in selling one's share due to liquidity constraints. | Generally, it is easier to sell the entire property, though market conditions can impact liquidity. |

| Accessibility | Grants access to premium real estate at more affordable prices. | Direct ownership of high-value properties requires a significant financial commitment. |

Timeshares vs Fractional Ownership

While timeshares and fractional ownership are often confused with one another, they meet different needs and provide different advantages. Timeshares are basically for holiday or vacation use. They grant the purchaser the right to use a property for a specified period, usually a week, every year. Normally, most of the timeshares do not grant an ownership interest in the property, so there is little or no possibility of financial return from property appreciation or rental income.

On the contrary, fractional real estate ownership is an investment and usage model. While both models provide a kind of shared use of high-value properties, fractional ownership combines the advantages of personal use with real estate investment benefits, hence making it more versatile and potentially highly lucrative compared with timeshares.

Tips for Investing in Fractional Ownership Real Estate

Fractional ownership is a strategic way to invest in real estate without many burdens associated with outright ownership. That means diversification into a portfolio and the potential return on appreciation in value and rental income make it a great investment opportunity. Success in fractional ownership requires careful planning, just like any other investment. The following are some of the essential tips to consider when handling fractional ownership:

Tip 1: Thorough research

Research the property and the market conditions before you get involved in investment. Investors need to understand the fractional ownership structure and specifics of the property and its location. This will assist in making an informed investment decision and enable an investor to project the returns that may be generated through the investment.

Tip 2: Assess management

Ensure that the property is managed by a reputable and experienced management firm. Professional management impacts the property’s maintenance and profitability. Look for firms with a good track record managing similar properties.

Tip 3: Understand the costs

Clearly mention all ongoing expenses, including maintenance fees, property tax, or management fees. These could reduce your return on investment, so make sure to incorporate these into your financial planning.

Tip 4: Review legal agreements

Go through all the legal documents concerning the fractional ownership arrangement. These documents will specify your rights, duties, and usage constraints. Consulting a real estate attorney can add more assurance to your interest protection.

Tip 5: Exit strategy evaluation

Be aware of the terms for selling your share and the restrictions involved. Some fractional ownership arrangements will have a secondary market for trading shares, while others might require holding your share for a certain amount of time before selling. Knowing your exit options will help you plan for any kind of liquidity or future financial needs.

Tip 6: Consider the investment horizon

Consider the investment time frame and goals. Fractional ownership can be long-term and should align with your financial objectives and time horizon. Ensure that the property and market conditions support such an expected investment duration.

Tip 7: Diversify your portfolio

Diversification reduces risk and increases returns. To balance out the potential risks and rewards, consider investing in a few different properties or in several types of real estate. The reduced capital requirement for real estate fractional ownership makes diversification much easier to achieve.

Tip 8: Staying current with the trends in the market

Keep yourself updated with respect to real estate market trends and economic factors that can possibly impact your investment. Noting the market condition regularly will help you decide at the proper time whether to hold, sell, or acquire more shares.

Frequently Asked Questions (FAQs)

Is fractional ownership a wise investment?

Fractional ownership can be a sound investment strategy for a large number of people as it helps in gaining possession of property at a more affordable price. Investors can diversify their investment portfolio with ease. This is mainly because it would be managed professionally and reduce personal time and effort for the property to be maintained at all times. However, investors must be aware that they will have limited influence over property decisions and possible problems with liquidating.

What are some drawbacks of fractional ownership?

The main disadvantages of fractional ownership are connected with the fact that you will have less control over property management and decision-making, which is spread among the group of investors. Additionally, exiting your investment can be quite bothersome and time-consuming compared with selling the whole property because of the liquidity constraint. There are also maintenance fees and management costs to be shared among the owners that may add up and impact the overall return on investment.

Why invest in fractional ownership?

Fractional ownership in real estate provides an opportunity to invest in real estate at a fraction of the full purchase price and facilitates investment in diversified properties. It has the potential to yield a financial return through rental income and property appreciation while reducing the financial burden of full ownership. The professional management services that come with fractional ownership also reduce the time and effort required to maintain the property. This becomes very helpful for people who wish to get all the monetary benefits related to real estate investment without actually committing to the financial and managerial responsibilities of sole ownership.

Bringing It All Together

Fractional ownership real estate provides access to valuable real estate investment opportunities without the high financial commitment and management responsibilities. Investors can benefit from expanded diversification, rental income, property appreciation, and professional management.

However, it comes with its own set of trade-offs, like reduced control over property decisions and possible difficulties in selling shares for liquidity. Ultimately, fractional ownership is very good for those who want to break into the real estate market without the full issues that arise from traditional property ownership.

Add comment