As a buyer’s agent, you’re not just a guide. You’re the ship’s captain, navigating your clients through real estate’s highs and occasional lows. Don’t worry—I’ve crafted the ultimate real estate buyer agent checklist to ensure your voyage is as smooth as that bottle of wine you’ll pop open at closing. From decoding your clients’ wishlists to celebrating the final walk-through, our checklist is your treasure map to creating an unforgettable homebuying adventure.

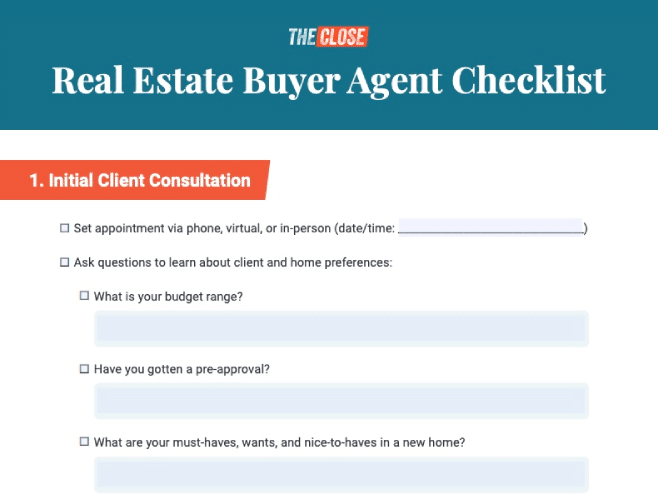

1. Initial Client Consultation Using the Real Estate Buyer Agent Checklist

The initial journey of using your buyer agent checklist starts with an in-depth consultation to gauge your client’s needs, lifestyle preferences, and financial readiness. This session is not just about ticking boxes—it’s about understanding their dreams for their future home. Share insights on the buying process, discuss their timeline, and set realistic expectations based on the current market. This foundational step builds rapport and tailors the search process to their unique situation.

Here are some questions you should be asking during this step:

- What is your budget range?

- Have you gotten a pre-approval?

- What are your must-haves, wants, and nice-to-haves in a new home?

- Do you have any deal-breakers?

- What is your ideal timeline for moving into a new home?

- Are there specific neighborhoods or areas you’re considering?

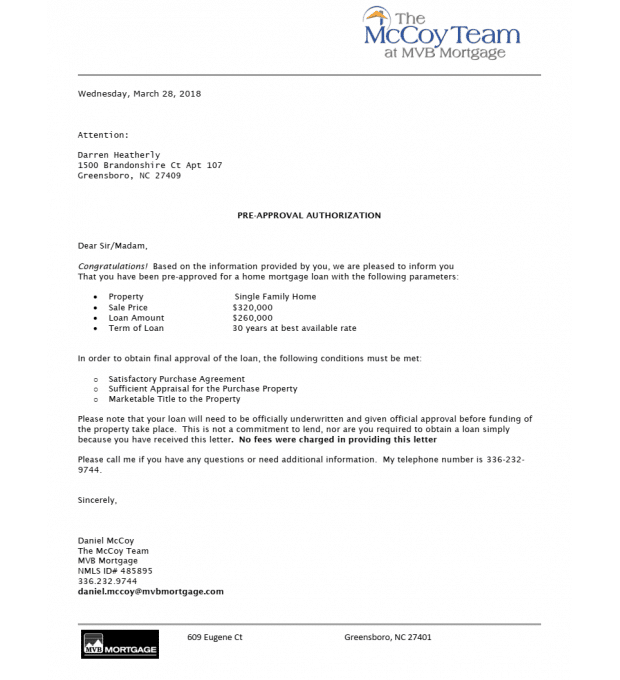

2. Financial Prequalification & Pre-approval

Navigate your clients through the financial maze of prequalification and pre-approval. Explain how these steps differ.

- Prequalification: Gives a ballpark figure of their budget for a house

- Pre-approval: Provides a more concrete financial limit and strengthens their offers to sellers

Assist them in gathering necessary documents, such as pay stubs, bank statements, pre-approval letters, and selecting a reputable lender to meet their needs. This early financial vetting can save time and direct the home search more efficiently.

3. Provide Market Education

Demystify the market for your clients by breaking down current trends and statistics, pricing, and inventory levels. Highlight how these factors influence their buying strategy and what they can realistically expect in their search.

For example, if you were in the real estate market during the craziness of 2020, you know the importance of having extreme market knowledge with clients. We faced interest rates hitting historic lows and buyer demand skyrocketing in some locations. This juxtaposition resulted in a highly competitive market, especially for properties that offered more space and amenities suitable for remote work and extended homestays.

To assist clients during this tumultuous time, I explained how the low interest rates presented a rare opportunity for buyers despite the overall uncertainty. However, given the increased competition for desirable homes, I also stressed the importance of acting decisively.

This type of well-rounded knowledge about the real estate market will benefit your clients immensely and showcase your expertise as a real estate professional. Remember, your clients are looking to you to steer the ship, so make sure they’re getting the most informed captain.

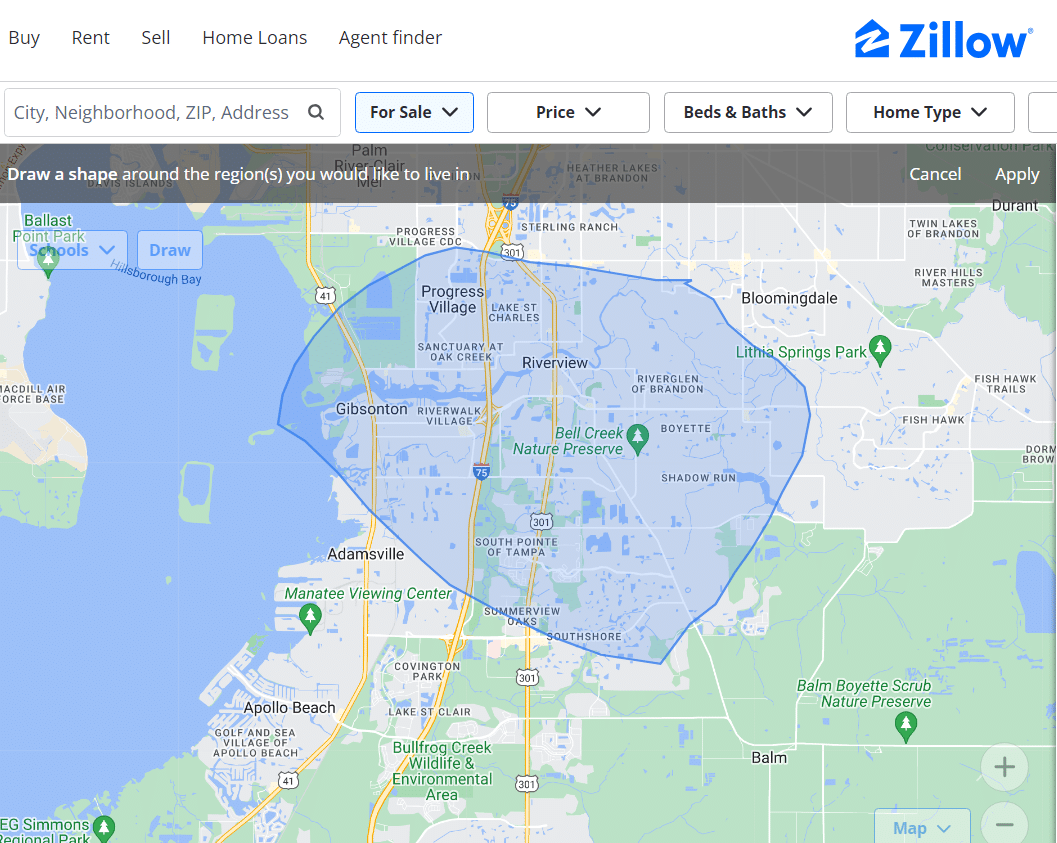

4. Help Them Choose a Neighborhood

In this step of your buyer’s agent checklist, help clients find the perfect neighborhood by discussing community features, amenities, commute times, etc. Consider their lifestyle and future needs to steer them toward areas that will feel like home for years to come.

For example, when agents have clients who strongly prefer outdoor activities such as hiking, kayaking, and water sports, they tailor the housing search to meet their lifestyle needs. Leverage mapping tools on real estate platforms to identify homes close to parks, lakes, and trails and do keyword searches for terms such as “water access” or “near trails” to pinpoint listings that boast these desirable features.

Agents should aim for a balanced approach when facing an abundance (or scarcity) of neighborhoods that meet their clients’ search criteria. When faced with many options, prioritizing neighborhoods based on the client’s most critical preferences ensures a focused search that yields meaningful results. In contrast, limited choices demand creativity and flexibility, exploring similar areas or adjusting criteria slightly to uncover hidden gems.

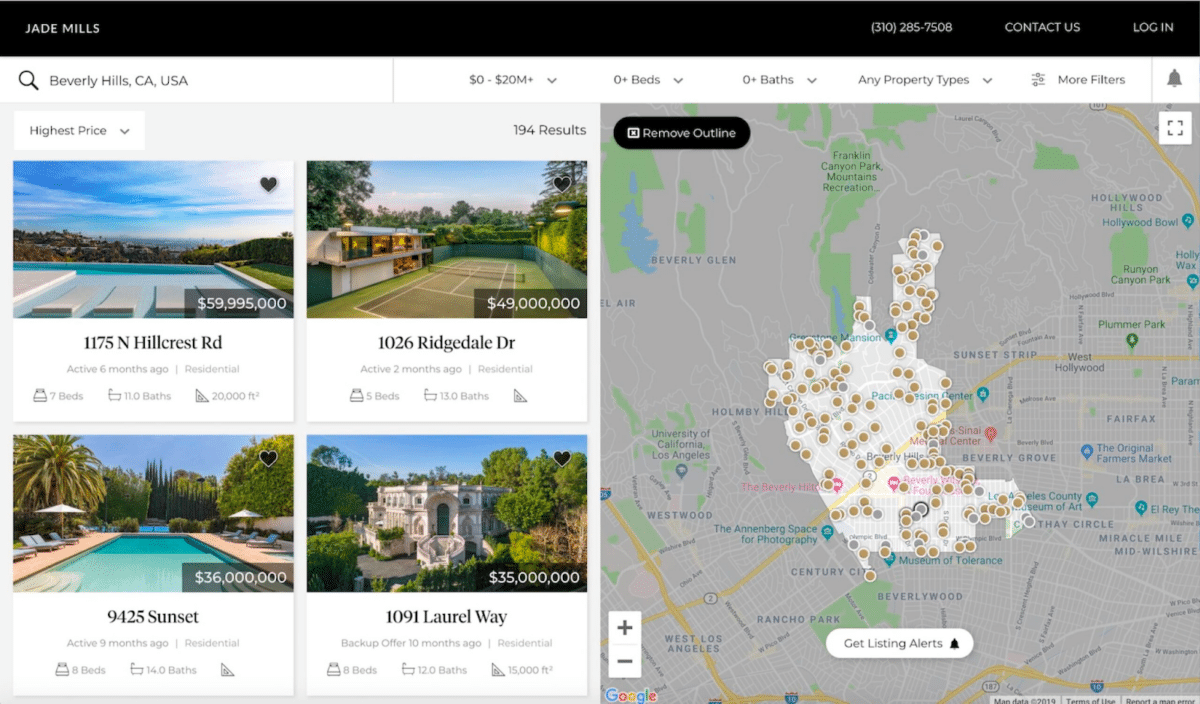

Zillow is a powerful ally for real estate agents and homebuyers, offering an intuitive platform that simplifies the search for the perfect home. Its robust search functionality allows users to precisely tailor their hunt based on a specific address, a preferred neighborhood, or even a ZIP code. From the initial search, agents can filter listings by price, layout, home type, and more, enabling a highly customized search experience.

5. Perform Home Search

Craft a personalized home search strategy using a combination of MLS listings, your professional network, and exclusive listings. Agents who utilize the MLS benefit from the ability to create and save customized searches for each client, ensuring they are immediately informed about new listings that match their criteria as soon as they become available. This strategy provides clients with the most current and relevant options and serves as a consistent touch base between agents and clients.

As clients navigate through the journey of viewing listings, here are some key questions to ask to help you refine your approach:

- What do you like about this property, and why?

- What do you dislike about this property, and why?

- How do you feel about the layout and space of this home?

- Can you see yourself living in this neighborhood?

- Is there anything missing in this home that you were hoping to find?

- How does this home compare to others we’ve seen?

- What are your thoughts on the price of this home?

- Does this home’s condition meet your expectations?

Incorporating these additional questions into property viewings deepens your understanding of your client’s needs, preferences, and expectations, allowing you to serve them more effectively. It demonstrates your commitment to not just any successful transaction but to ensuring their success and satisfaction with one of the most significant decisions in their lives.

6. Property Viewings

Organize efficient and informative listing appointments and viewings by providing clients with property details, history, and potential red flags beforehand. To ensure each viewing is as productive as possible, prepare a comparative market analysis (CMA) for each property to give clients a clear understanding of the home’s value in the current market context.

Coordinate closely with the listing agent to arrange visits at open houses and gather any additional insights they can offer about the property and its history. Before scheduling viewings, find out your clients’ availability to make the process as convenient for them as possible, accommodating their schedule to maximize the use of their time. During tours, highlight the positives and negatives, helping them visualize living in the space and teaching them to look beyond staging to assess the home’s true potential and fit their needs.

Before each property showing with your client, ensure you take a moment to set the stage for their viewing experience and manage their expectations. Use the following script to prepare them:

Before we walk through the door of [Property Address], I want to share a few key points about this property to help you visualize its potential and understand how it aligns with what we’ve been searching for.

This home features:

- [Mention the basic features: number of bedrooms, bathrooms, etc.]

- [Highlight any significant positive attributes]

While it might not have [mention any specific features the client wanted but the property lacks], the [mention any compensating positive aspects] and its location in [mention the neighborhood or area] offers [mention specific benefits of the location].

Considering your priorities and our discussions about balancing must-haves with nice-to-haves, let’s explore this space with an eye for its unique possibilities and how it could become the home you’re looking for.

If you show clients your exclusive listings, you can significantly enhance the showing experience by leveraging Curb Hero. It’s an innovative open house tool with instant access to detailed property information and seamlessly checking in visitors. Through Curb Hero, agents can effortlessly gather feedback, track visitor interest, and tailor follow-up communications to address specific preferences or questions, thereby improving the chances of converting showings into successful sales.

7. Make an Offer

When you finally hit the point in your buyers checklist for realtors to make an offer, guide your clients through crafting a compelling package with a competitive price, realistic contingencies, and a personalized letter to the sellers. Offer negotiation strategies based on your experience and the specific market dynamics. Prepare them for possible counteroffers and the next steps once an offer is accepted.

During the offer process, if I wanted my clients to be competitive when there were other offers on the table, I would employ the following strategies to ensure my client’s offer stood out:

- Pre-approval letter: Including a pre-approval letter from a reputable lender with the offer demonstrates that the buyer is serious and financially capable of purchasing the home, giving the seller confidence in the buyer’s offer.

- Escalation clause: In response to competing bids, utilize an escalation clause to automatically increase your client’s offer in predetermined increments up to a maximum limit. This step ensures your client remains competitive without initially overpaying.

- Limited contingencies: While some contingencies are necessary for the buyer’s protection, limiting them can make an offer more attractive to sellers by reducing potential hurdles to closing. For instance, being flexible about the closing date to accommodate the seller’s schedule can be very appealing.

- Earnest money deposit: Offering a higher earnest money deposit can signal a strong commitment to the transaction, potentially swaying sellers in competitive situations by showcasing the buyer’s seriousness.

8. Coordinate Inspection

During this step, stress the importance of a thorough inspection to uncover any hidden issues in this part of the buyer checklist for realtors. Recommend trusted inspectors to your clients and attend the inspection to ask questions and understand potential concerns. Post-inspection, review the report with your clients and decide on the best course of action, whether requesting repairs or renegotiating the deal.

Check out our article on 33 Critical Questions to Ask Home Inspectors for a list of critical questions to ask during an inspection.

9. Negotiating Repairs for the Client

Leverage the inspection findings to negotiate necessary repairs or concessions with the seller. Prioritize issues based on cost, safety, and impact on the home’s value. Aim for a fair resolution that keeps the transaction moving forward while protecting your client’s interests.

One time, I had buyers prepared to finalize their home purchase. Their offer was contingent on the inspection. When we received the inspection report, we found that some minor electric repairs were needed. We offered the seller the option to fix the issue and proceed with the deal, or we would need to deduct some of the expected cost from the offer price. In this scenario, the seller was able to fix the issue quickly, and we closed the deal within a few weeks.

While some repairs aren’t this easy to fix, there is always a negotiation opportunity to get the situation moving. There’s always a solution, whether that’s the seller or buyer paying the total amount for repairs, splitting the difference, the sellers giving credit so the buyers can get it fixed on their own, or just bypassing the repairs until later (as long as it’s safe). Your job as the real estate agent is facilitating that solution to satisfy the buyer and keep the deal moving forward.

10. Schedule the Appraisal

The appraisal process is critical in the homebuying journey. It unbiasedly evaluates a property’s market value. Conducted by a licensed appraiser, this assessment ensures lenders do not provide more financing than the property is worth, protecting both the lender’s and buyer’s investments.

Here are some scenarios buyers’ agents might encounter during this process and strategies to handle them:

When an appraisal comes in lower than the offer price, it can jeopardize the financing and potentially the sale. In this scenario, buyers’ agents have several strategies:

- Renegotiate the price: Encourage the buyer to negotiate a lower sale price with the seller, arguing that the appraisal reflects the current market value.

- Challenge the appraisal: If there are grounds to believe the appraisal was inaccurate or overlooked certain aspects of the property, the buyer can request a review or a second appraisal.

- Cover the gap: The buyer may opt to cover the difference between the appraisal and the offer price in cash if they believe the property is worth the extra investment and have the means to do so.

Though less problematic, an appraisal higher than the offer price indicates the buyer is getting a good deal, with instant equity in the property. While this scenario doesn’t require immediate action, it’s an excellent opportunity for buyers’ agents to highlight the value the buyer is gaining, reinforcing their decision.

When the appraisal matches the offer price, it affirms the agreed-upon value of the property, satisfying both the buyer and the lender. This scenario typically allows the buying process to proceed smoothly toward closing.

11. Request a Title Search

Involving a reputable title company to conduct a thorough title search is critical to homebuying. It safeguards your clients’ interests by ensuring the property is devoid of encumbrances like liens, easements, or any legal issues impacting ownership rights.

The title company’s detailed scrutiny of public records will confirm the seller’s legal authority to sell the property and reveal any existing claims or limitations. This step is fundamental in providing peace of mind to your clients, confirming that their prospective home is clear of hidden complications that could jeopardize their claim to ownership.

Some issues that might arise during a title search:

- Unpaid property taxes leading to tax liens

- Outstanding mortgages or home equity lines of credit not discharged

- Judgments against the property owner for unpaid debts

- Easements granting rights to use part of the property to others

- Incorrect or disputed property boundaries

- Claims of adverse possession or encroachments by neighbors

- Mechanic’s liens from contractors for unpaid work

- Liens for unpaid homeowners association (HOA) dues or assessments

- Errors in the public record, such as incorrect names or legal descriptions

- Claims from heirs or previous owners not correctly recorded or resolved

- Restrictions or covenants limiting the use of the property

- Forgotten easements that allow utility companies access to the property

- Pre-existing leases that grant use of the property to tenants

The first step in cases encountering title search issues is to consult with a real estate attorney or title company to understand the legal implications and explore resolutions. Solutions may involve negotiating with lien holders, rectifying public record errors, or mediating boundary disputes. Ensure all agreements are formally documented and recorded to clear the title.

12. Finalize Mortgage

Although real estate agents are not directly responsible for processing mortgages, their involvement is critical in guiding clients through the mortgage finalization process. They serve as a bridge between clients and lenders, facilitating clear communication and helping gather necessary documents for loan approval. By explaining complex loan terms and conditions, offering strategies to improve loan approval chances, and monitoring the application’s progress, agents ensure clients are well informed and prepared for closing.

For example, I had a client who was in the process of purchasing a property. During a casual conversation, the client mentioned their interest in buying a brand-new car. Upon hearing this, I immediately advised them of the potential repercussions this could have on their debt-to-income ratio and credit, which are vital factors lenders consider in the mortgage approval process.

I explained that making such a significant purchase before finalizing their home loan could jeopardize their mortgage approval, as lenders might view the increased debt as a risk to their ability to repay the home loan. Thankfully, they understood the situation and postponed the car purchase until after the home closing.

Being proactive in the mortgage process not only smooths the path to closing but also cements your reputation as a trusted adviser, enhancing the overall client experience and fostering future referrals. This support for your clients should extend to preparing them for what to expect on closing day, making sure they understand all financial commitments and verifying that funds are ready for transfer.

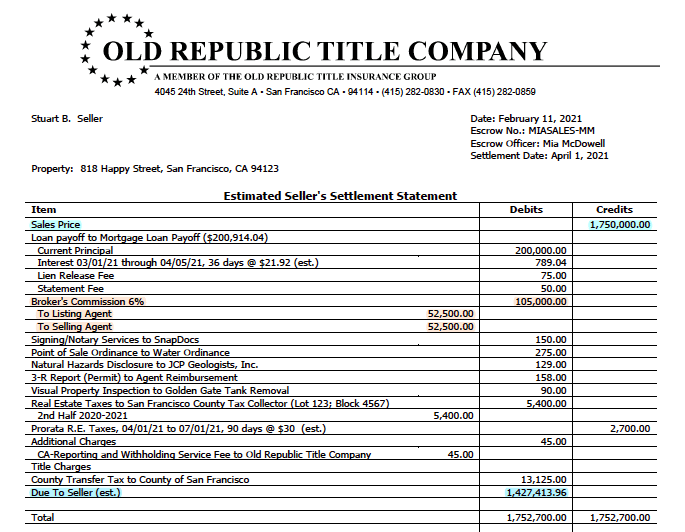

13. Review Closing Document

Before closing, review all documents with your clients, ensuring they understand each part of the agreement, from the mortgage terms to the closing costs and property transfer details. This review minimizes surprises and ensures a smooth closing day.

14. Perform Final Walk-through

Accompanying your clients on the final walk-through is a critical step in the homebuying process, offering a last opportunity to ensure the property is in the promised condition before they make the final commitment. This walk-through allows you and your clients to verify that all contractual obligations, especially repairs agreed upon after the home inspection, have been completed satisfactorily. It’s also the time to check that the house is as expected, with no unwanted surprises or changes since the last visit.

Things to check at the final walk-through:

- Completion of agreed-upon repairs: Confirm all repairs outlined in the contract are completed.

- Operational systems: Test HVAC, water heater, and plumbing to ensure they work correctly.

- Electrical systems: Check all light switches, outlets, and fixtures for functionality.

- Windows and doors: Ensure all windows and doors open, close, and lock smoothly.

- Ceilings, walls, and floors: Inspect for new damage or issues.

- Exterior inspection: Examine the roof, siding, and gutters for condition and damage.

- Pest and mold inspection: Look for signs of new pest infestations or mold growth.

- Included items: Verify all items included in the sale are present and in good condition.

- Cleanliness: Check that the property is clean and free of the seller’s belongings.

- Security and safety: Test smoke detectors and ensure all keys and codes are provided.

By ensuring a thorough and attentive final walk-through, you play a crucial role in guaranteeing that your clients make a well-informed and confident final decision on their new home. This attention to detail helps secure a smooth homeownership transition and reinforces your commitment to their satisfaction, contributing to a positive and memorable homebuying experience.

15. Coordinate Closing

Facilitate the closing process by coordinating with the closing agent, lender, and seller’s agent. Ensure your clients know what to expect, what to bring, and the significance of each step in this final purchase phase. Your guidance here can alleviate any last-minute stresses. This time is also an excellent opportunity to review your real estate buyer agent checklist to ensure you haven’t missed anything.

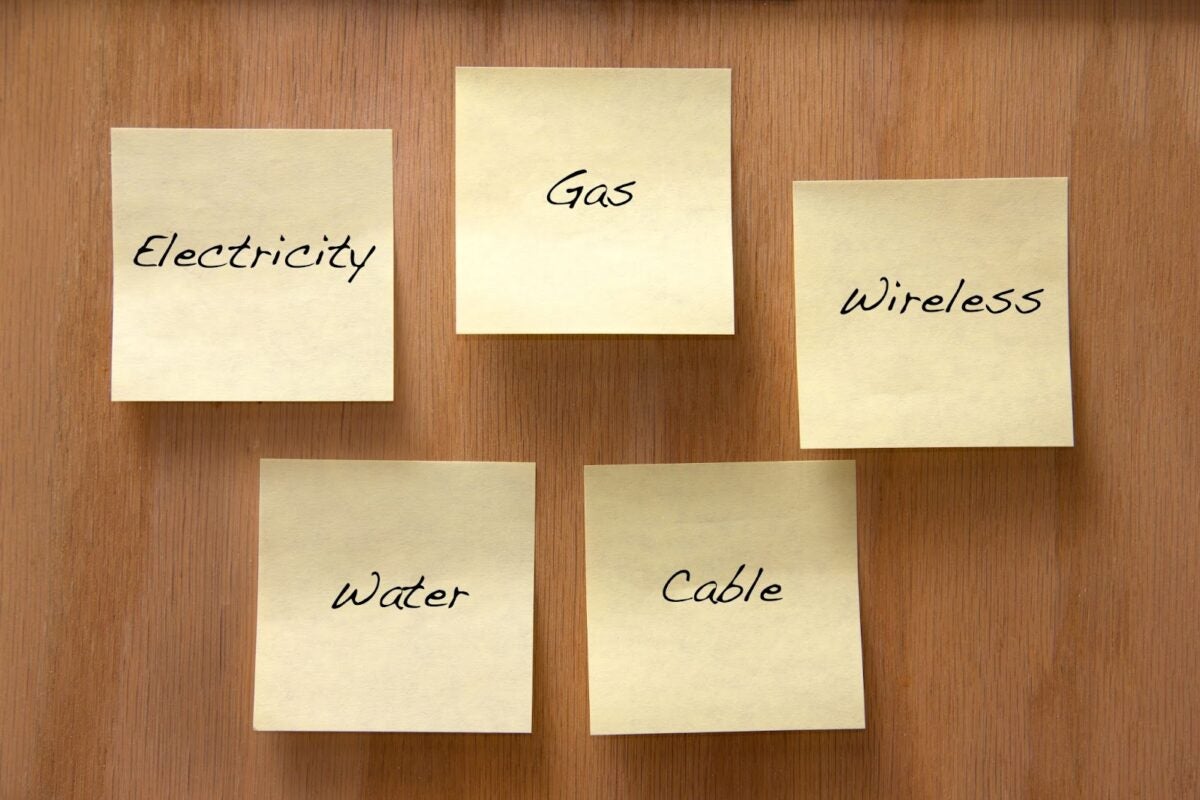

16. Help With Utilities & Services Transfer

Remind your clients to transfer utilities and essential services into their name to ensure a seamless move-in. Provide a comprehensive list of contacts and deadlines for setting up everything from electricity and gas to internet and trash collection. This step is particularly helpful for first-time homebuyers who may need to become more familiar with transferring utilities into their name.

The utility list for your client should include:

- Electricity: Contact information for the local electricity provider. The suggested start date for service is to ensure power is on upon move-in.

- Gas: Give them the local gas company’s contact details. To avoid heating disruptions, a recommended timeline for initiating service is critical in colder climates.

- Water and sewer: Utility provider’s contact details for water services. Instructions for establishing the account, including any necessary deposits or fees.

- Trash and recycling: Information on the local waste management company. Schedule for trash and recycling pickup, including any community-specific recycling programs.

- Internet and cable: Provide a list of available service providers in the area. Include tips for comparing packages and deals tailored to the client’s needs.

- Telephone: If needed, offer landline options, including traditional telephone service providers and voice-over-internet-protocol (VoIP) alternatives.

17. Handover of Keys to Client

Make the key handover a memorable moment. This pivotal occasion marks the culmination of your shared journey and a new beginning for the homeowners. Whether through a small celebration, a thoughtful gesture, or personalized closing gifts like cutting boards, towels, or holiday decor, ensure this moment is special.

A gift for their new home or something sentimental that reflects their journey can add a lasting touch to the celebration. It’s not just about congratulating and wishing them well in their new home—it’s about commemorating the milestone they’ve achieved and your role in it. This thoughtful approach enhances the closing experience and strengthens the relationship, leaving a positive, lasting impression as they start their new chapter.

18. Provide Post-closing Support

The final task in your real estate buyer agent checklist is to offer ongoing support after closing, answering any lingering questions and helping with unexpected challenges. This continued engagement reinforces your commitment to their satisfaction and lays the groundwork for a lasting professional relationship.

Challenges and questions you might encounter post-closing:

- Homeowner Association (HOA) rules: Clients new to HOAs may need to know specific regulations. Guide them on where to find the HOA rules and how to engage with the association effectively.

- Unexpected repairs: They might discover issues the inspector should have caught during the inspection. You can help by suggesting how to prioritize repairs and recommending professionals.

- Understanding home warranty coverage: If a home warranty was part of the deal, clients might have questions about what’s covered. Help them learn how to use their home warranty effectively for repairs and replacements.

- Mail and package delivery: Questions about changing addresses and setting up mail forwarding are common. Guide them through the process with the postal service and advise on securing their mail, especially in areas prone to package theft.

Sometimes, these concerns fall outside your jurisdiction as an agent. However, providing guidance or pointing your clients in the right direction underscores your commitment to their satisfaction. Even when specific issues extend beyond real estate transactions, offering resources, referrals, or a listening ear can make a significant difference.

19. Send a Resource List of Providers

Provide a curated list of trusted local service providers, from contractors and landscapers to plumbers and electricians. This resource helps new homeowners settle in and manage their homes effectively, adding value beyond the sale. While the deal has already closed, offering such a list is a bonus, enhancing the client experience.

It demonstrates your commitment to their well-being even after the transaction is complete. This thoughtful gesture not only aids in retaining clients for future real estate needs but also increases the likelihood of referrals to new ones. By going the extra mile, you cement a positive, lasting impression, fostering a network of satisfied clients who are likelier to recommend your services to friends and family.

20. Perform Follow-up Checks

Continue to check in with your clients after moving in, offering advice and support as they adjust to their new home. These follow-ups can turn clients into lifelong advocates for your services, enhancing your reputation and referral network.

Here are some strategic ways to stay in touch:

- Send a personalized text or email: A few weeks after they’ve settled in, send a personal message asking how they are enjoying their new home and if there’s anything more you can do to assist them.

- Request referrals: Once you’ve established that your clients are satisfied, gently ask if they have friends or family who might need your services. Phrase it in a way that shows you value the trust they place in you.

- Initiate an email drip campaign: Enroll them in a carefully curated drip email campaign that provides ongoing value. This added value can include home maintenance tips, updates on local real estate trends, and reminders for crucial homeownership deadlines (e.g., property tax payments and routine maintenance checks).

- Seasonal greetings: Send cards or messages during holidays or on the anniversary of their home purchase. This outreach keeps the relationship warm and shows you remember and value them.

- Provide local market updates: Regularly update them on the local real estate market, including recent sales in their neighborhood and trends affecting home values. This market data update can help them stay informed about their investment and position you as a knowledgeable resource.

- Organize client appreciation events: Host annual or semi-annual events for past clients. These events can be a great way to stay in touch and show appreciation while networking for referrals in a friendly, social setting.

FAQs

How frequently should I update my homebuying checklist for clients?

Keeping your homebuying checklist up to date is crucial to staying relevant and effective in the ever-evolving real estate market. Regular updates, at least once a year or whenever significant changes in market conditions or buying processes occur, ensure you provide clients with the most current advice and resources. This includes adjusting for new lending regulations and market trends or introducing new technology and tools to aid homebuying.

How can I best prepare my clients for potential challenges during the homebuying process?

Preparing your clients for potential challenges during homebuying is crucial for a smooth journey. Start by setting realistic expectations about market conditions, including competition and pricing trends. Educate them on the importance of pre-approval for a mortgage and the potential for appraisal and title issues. Discuss the significance of inspections and how to negotiate repairs. Provide guidance on making competitive offers and the possibility of facing multiple offer situations. Finally, emphasize the importance of flexibility and patience and assure them of your support and expertise every step of the way.

What’s the benefit of having a buyer’s agent checklist?

A buyer’s agent checklist is a tool for streamlining the homebuying journey, bringing unparalleled benefits to agents and their clients. For agents, it not only elevates efficiency and organization by serving as a comprehensive roadmap through every step of the process, but also underscores professionalism and ensures consistent, high-quality service delivery. It fosters improved communication, allowing for clear expectations and informed decision-making. Additionally, the checklist’s adaptability enables agents to tailor their approach to each client’s unique needs to mitigate risks and enhance client satisfaction.

Bringing It All Together

This buyer’s agent checklist emerges as your secret compass to guide you through the intricate homebuying process with finesse and confidence. It identifies tasks and milestones that define your journey as a guide to prospective homeowners, from the initial discovery of needs to the thrilling moment of key handover. Armed with this checklist, you become a trusted navigator ready to tackle unexpected turns and lead your clients to the doorstep of their dreams.

How did you like our downloadable checklist, and did it provide everything you needed? If it did, tell us what worked best for you. If not, tell us how we can improve it!